Executive Summary

Over three months in summer 2025, UK Heritage Pulse is undertaking The Big Think — a sector-wide conversation shaped around three critical questions, one each month.

Key findings from the June 2025 research, exploring the second of the three Big Questions, “What bold choices must we make about our buildings, collections, and public offer to ensure a sustainable future?” show:

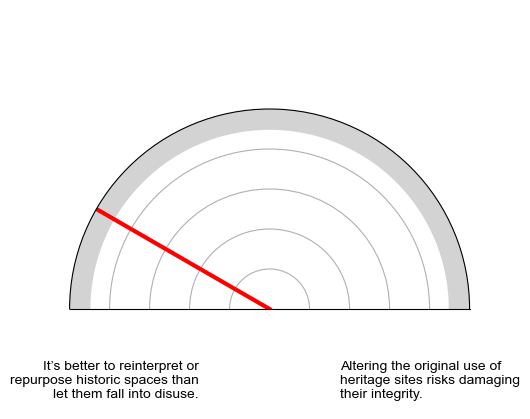

- Nine in ten respondents agreed that it is better to reinterpret or repurpose a heritage asset, rather than let it fall into disuse

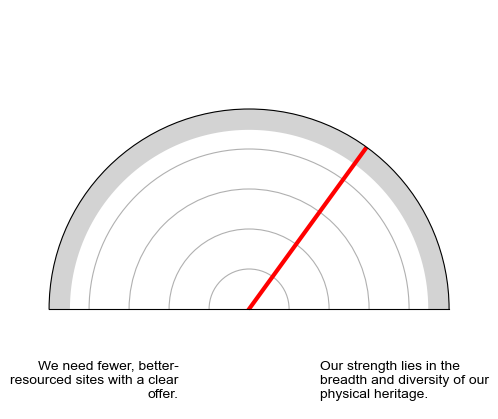

- Three quarters of respondents agreed that the sector’s strength lies in the breadth and diversity of its physical heritage, rather than focusing on fewer sites

- Panel members believe heritage is an asset that they need to protect for future generations.

Pulse Monitor

Taking the pulse of the people who care for our shared heritage:

- Respondents believe their work is having an impact on their heritage and community

- However, as the summer begins, more panel members are reporting they are uncomfortably stressed in their roles.

Survey Report (The Big Think)

In June, a total of 109 UK Heritage Pulse panel members responded to at least one question.

This month we continued The Big Think – a sector-wide conversation shaped around three critical questions, one each month. This month we asked respondents: What bold choices must we make about our buildings, collections, and public offer to ensure a sustainable future?

Panel members answered by agreeing or disagreeing with a series of statements or sharing their own reflections. Subsequently, we posed the monthly “Pulse Monitor”, questions, which track the individual and organisational resilience of panel members.

This report will provide a provisional summary of the results for this month’s Big Question. In July’s final round, respondents will be invited to complete any questions they have not already answered, with the full results published at the conclusion of The Big Think.

Strategic Choices for Sustainability

Panel members believe heritage is an asset that requires contemporary interpretation

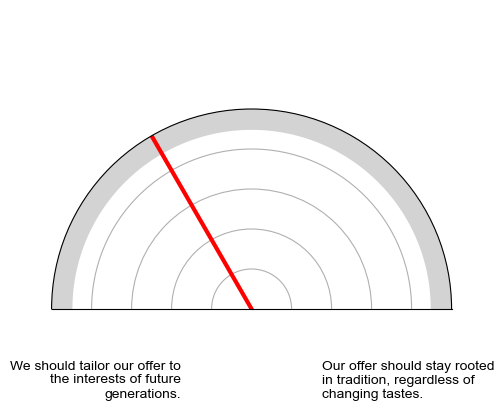

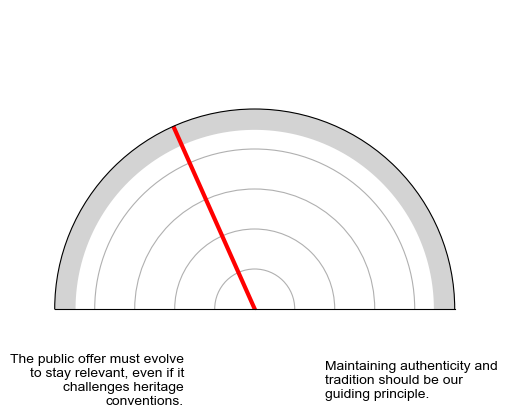

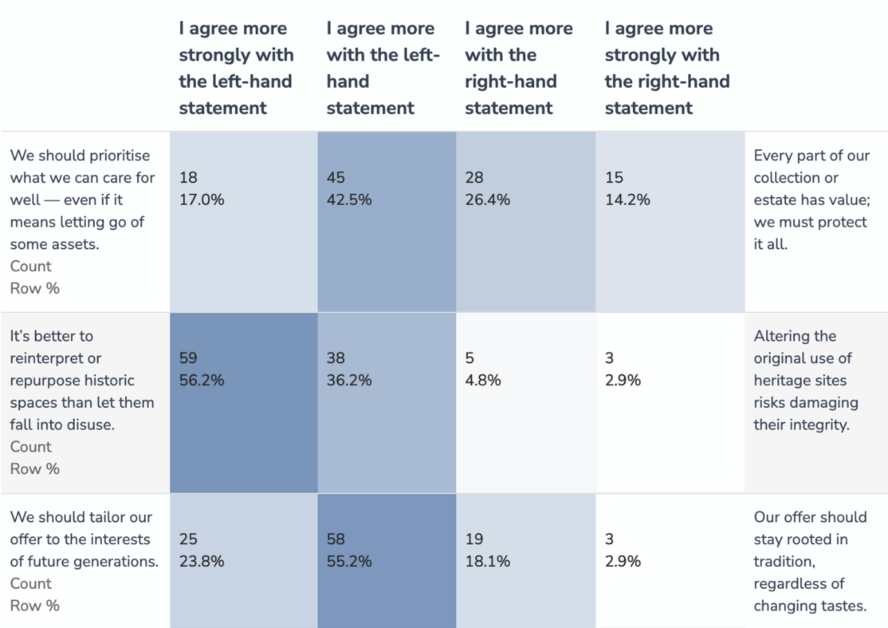

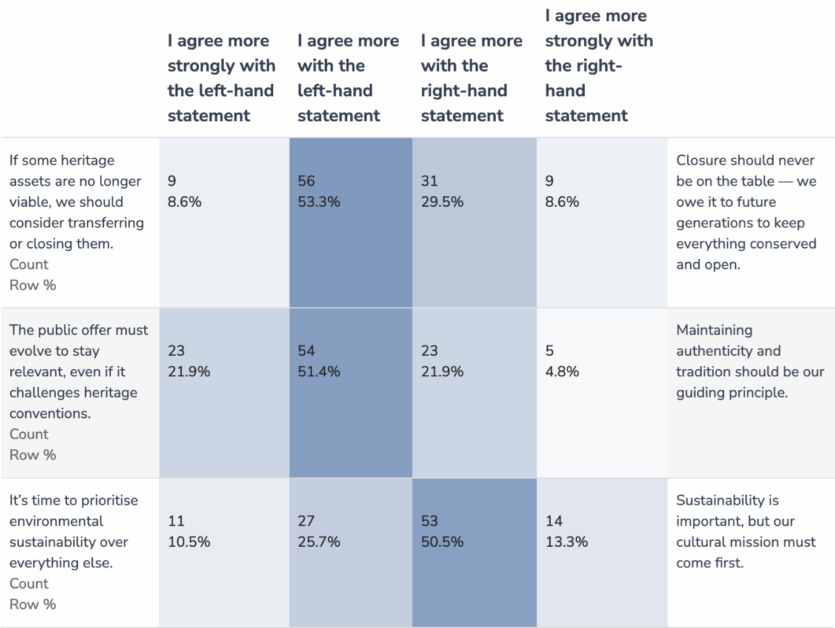

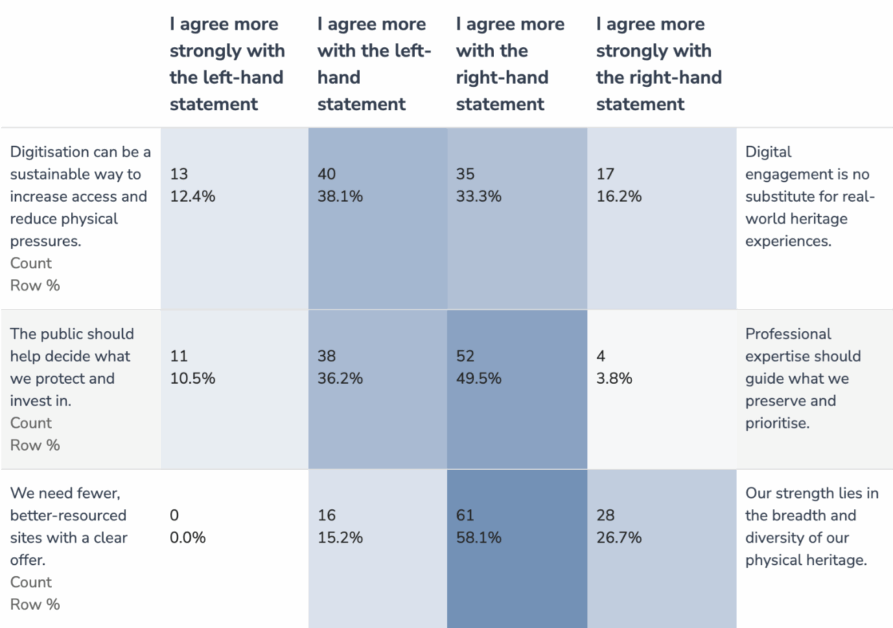

We asked panel members a series of thought-provoking yet contrasting statements, asking them which opinion they found more persuasive and the strength of their agreement. This was measured along a four-point scale.

The panel believe that:

- The sector must embrace entrepreneurial thinking to survive: 1.52 / 4, versus “Business thinking has no place in heritage organisations”

- Our strength lies in the breadth and diversity of our physical heritage: 3.11 / 4, versus

- “We need fewer, better-resourced sites with a clear offer.”

There was a preference amongst respondents that:

- Their offer should be tailored to the interests of future generations: 2 / 4

- Their public offer must evolve to stay relevant, even if it challenges heritage conventions: 2.1 / 4

- Their cultural mission comes ahead of sustainability: 2.7 / 4

When looking at the distribution of responses, we can see emerging preferences that:

- 62% of respondents agreed that if some heritage assets are no longer viable, we should consider transferring or closing them, versus: Closure should never be on the table — we owe it to future generations to keep everything conserved and open.

- 59% of respondents agreed we should prioritise what we can care for well, even if it means letting go of some assets, versus: Every part of our collection or estate has value; we must protect it all.

Respondents were undecided on the following propositions:

- Digitisation can be a sustainable way to increase access and reduce physical pressures, versus: Digital engagement is no substitute for real-world heritage experiences.

What bold choices must we make about our buildings, collections, and public offer to ensure a sustainable future?

n=106

“We have a duty to preserve the past” – choices are driven by respondents’ core mission

Following the statements, panel members were invited to give any additional comments. Respondents commented that their choices to deliver sustainability were taken in the context of ensuring their sites continued to exist for future generations:

“Heritage sites and buildings are only borrowed by the present for a brief time. They come with a very wide range of needs and any intervention strategy must be respectful, compassionate and responsive.”

Panel members believe funding structures do not encourage sustainability

For those who did not want to complete the statements, panel members had the opportunity to respond directly to the Big Question.

Respondents identified a tension they saw between the sustainability of their heritage and their organisation, particularly in the context of the funding envrionment:

“Do we look at sustaining the current building as is, or do we look at adapting to the climate? What about the sustainability of our organisation, can we keep relying on unreliable funding, but there is no other alternative.”

“[We should] move away from a climate of short term project funding which does not create resilience, but feeds the project economy.”

Read more

The National Lottery Heritage Fund provides organisational sustainability and resilience good practice guidance, which can be read here

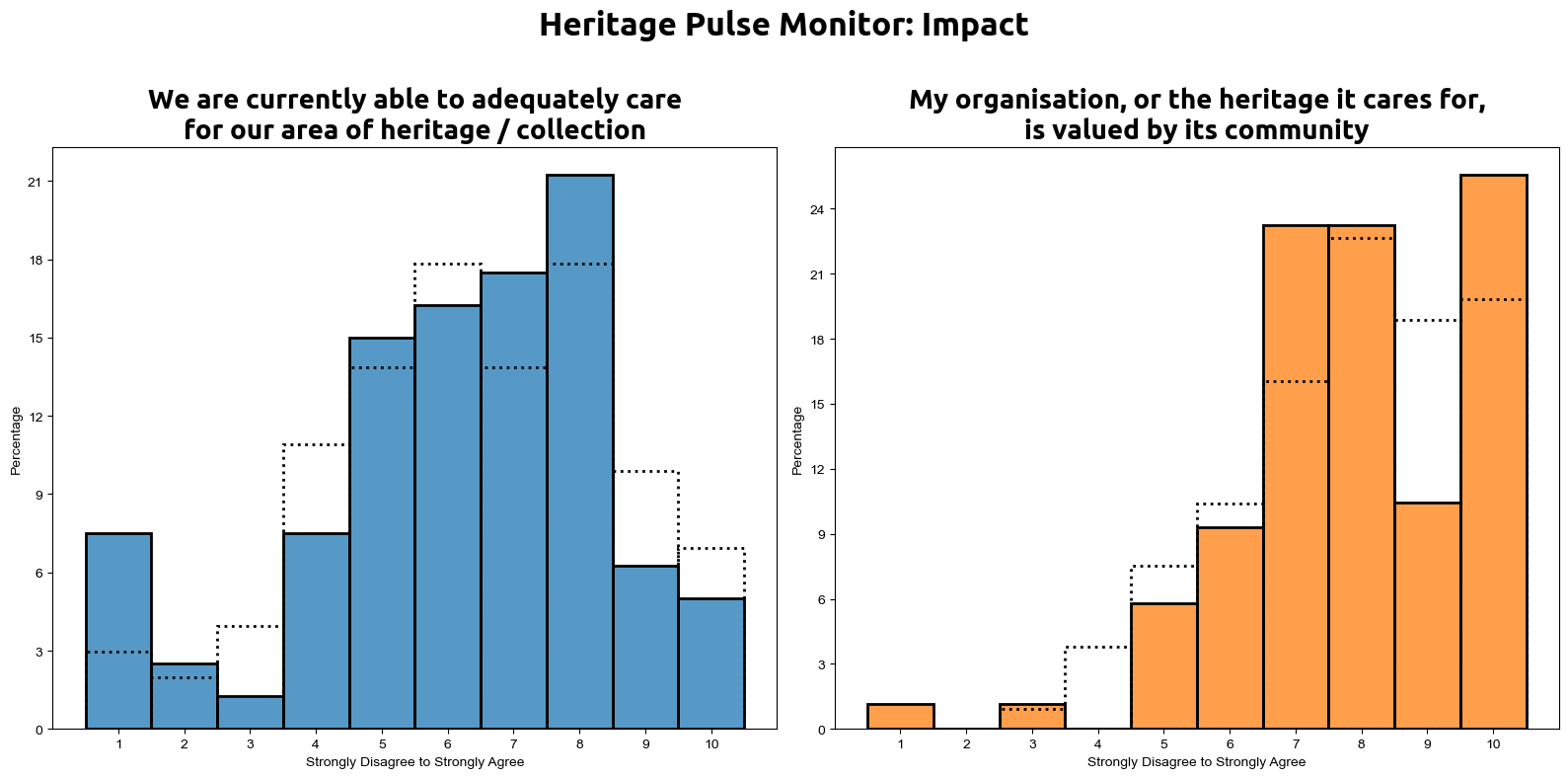

Pulse Monitor

Pulse Monitor is a monthly health check on the heritage sector, measuring its resilience, confidence and ambition.

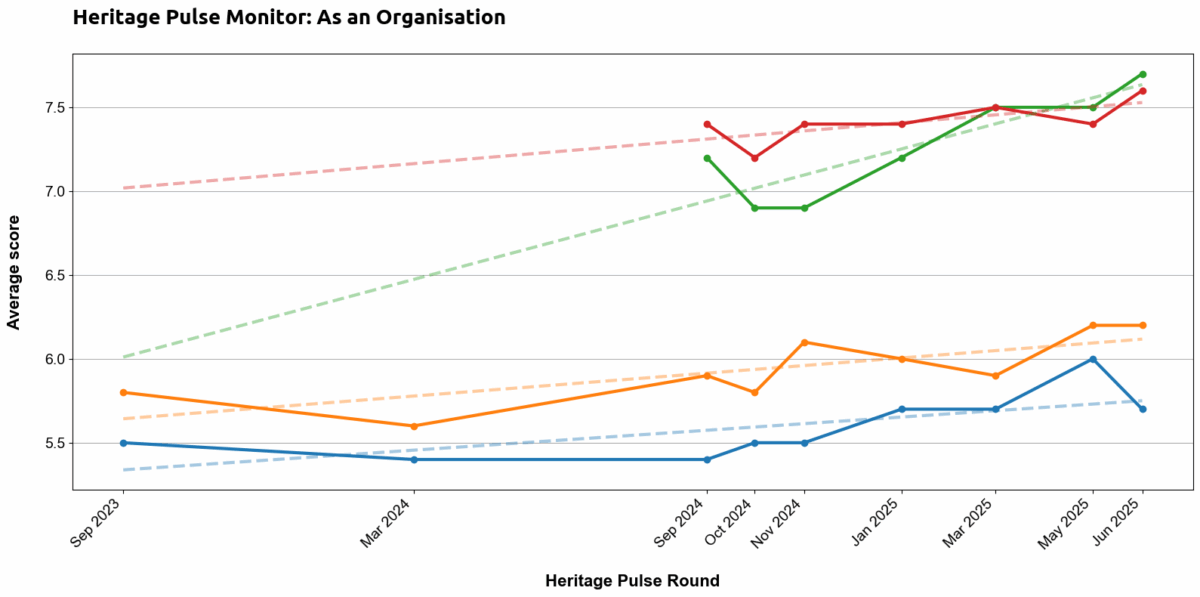

Confidence in facing cost and recruitment challenges stalls

94 panel members completed this question

Despite a positive trend, panel members’ ability to retain and recruit new volunteers/staff as needed fell back this month to 5.7 / 10. Respondents’ ability to adapt to income and cost challenges remains stable, equalling its result in the previous round.

Respondents’ belief that they can survive the coming 12 months (7.7 / 10) and understanding of their objectives (7.6 / 10) increased this month, reaching the highest levels in Heritage Pulse.

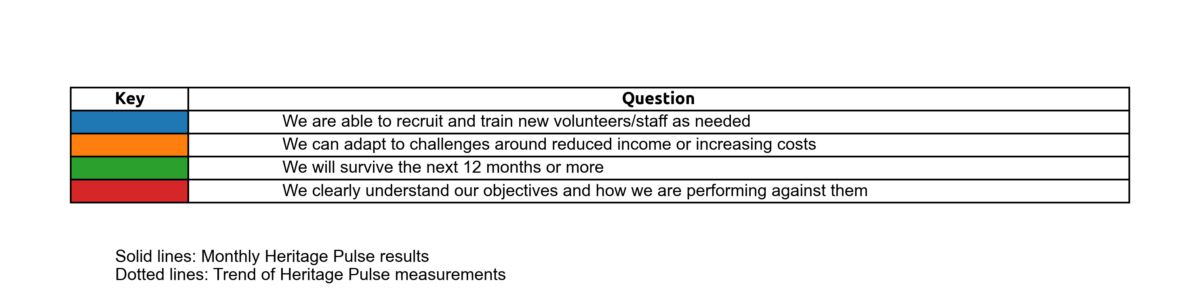

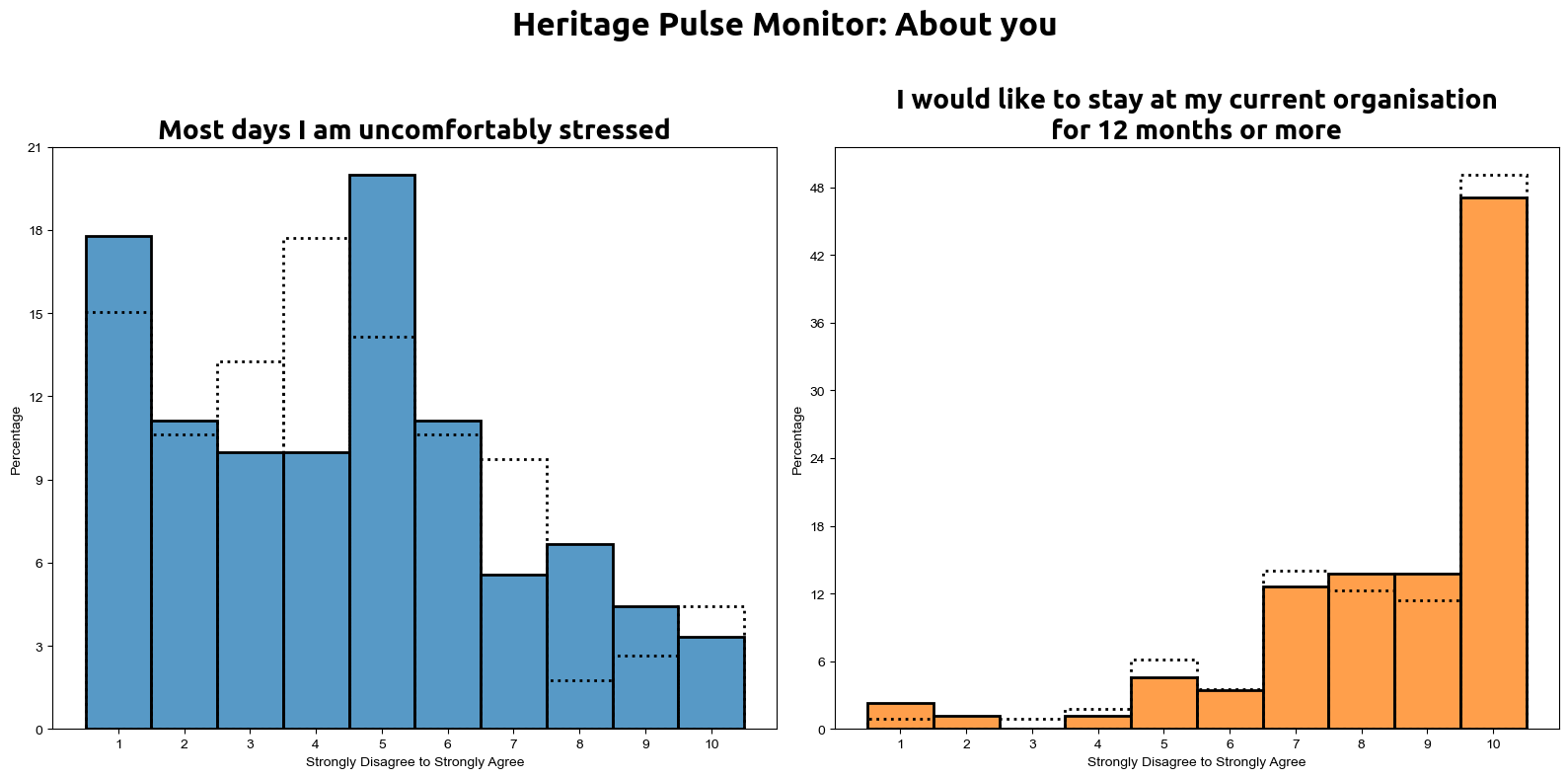

We can analyse the distribution of responses this month (in colour) compared to the previous survey (dotted outline).

Half of respondents scored 10 / 10 when asked if they will survive the coming twelve months. There was the most disagreement amongst the panel this month when asked about the recruitment challenges they face.

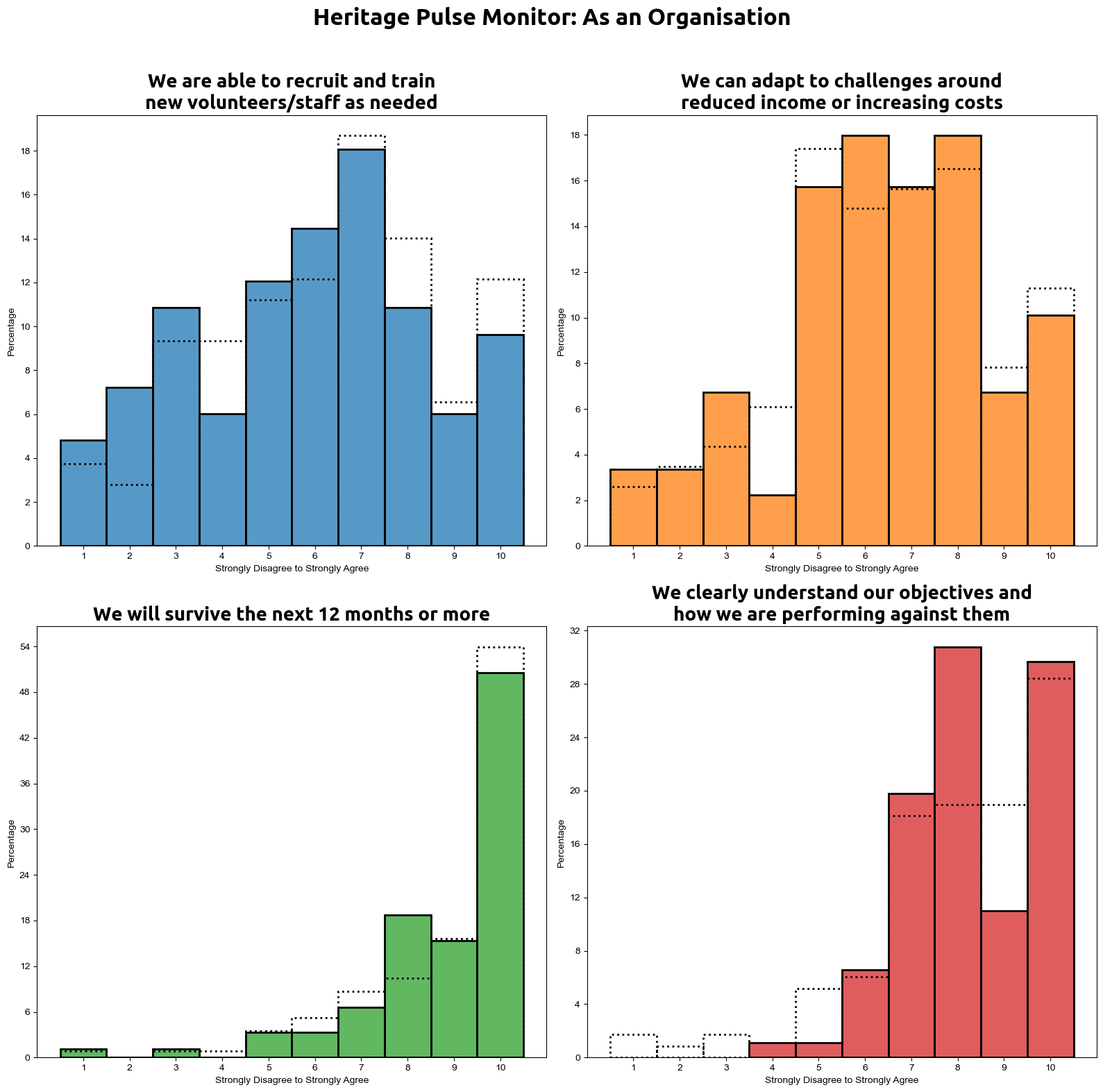

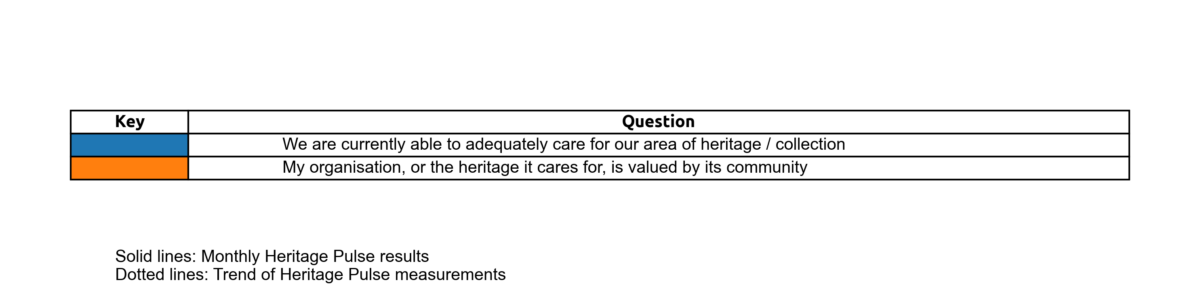

Respondents’ assessment of their impact increases

93 panel members completed this question.

Respondents’ belief that they can adequately care for their collection / heritage and that their work is valued by their community saw increases on May, continuing the upward trend for both measures.

More than half of respondents gave a score of 8 or above when asked about the community’s value of their heritage. When asked about their ability to care for their heritage, there was a shift to responses between 5-8 / 10.

Reported stress of respondents grows

92 panel members completed this question

Panel members’ desire to stay at their current organisation for the following 12 months increased to 7.2 / 10, against a downward trend. The reported stress of participants increased to 5 / 10, matching its highest score in Heritage Pulse.

Looking at the reported stress of panellists, we can see a move from 3-4 / 10 to the higher end of the scale. This question saw some of the widest distribution of responses in the survey.

Around 50% of respondents scored 10 / 10 for their desire to stay at their current organisation, consistent with the distribution from the previous round.

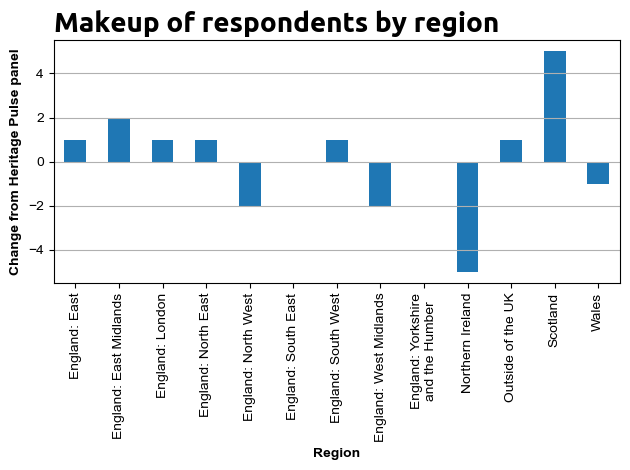

How representative of the Heritage Pulse panel were the June 2025 respondents?

Compared to the entire panel, respondents based in Scotland were the most overrepresented in this survey (plus five percentage points. By contrast, panel members in Northern Ireland were the most underrepresented, with the total proportion of respondents five percentage points lower than their total in the panel. This was followed by the North West of England and the West Midlands, 2 points lower than their respective totals.

ENDS