Executive Summary

Key findings from the March 2025 research, focusing on family visitors and their engagement with heritage and arts organisations, in partnership with Arts Professional:

- Family spending behaviour is evolving – While 50% of respondents saw no change, some reported declines in shop sales and donations. Others successfully increased spending by adding value to experiences.

- Family attendance is increasingly driven by events – 40% of respondents use events to attract families, with 20% specifically designing experiences for children.

- Grandparents are a growing driver of attendance but not spending – Many sites reported that grandparents are now key in bringing children, sometimes increasing footfall but not necessarily boosting revenue.

Family visitors remain crucial to heritage and arts organisations, but their behaviours are shifting in response to economic pressures. Price sensitivity is affecting attendance and on-site spending, with families seeking free or lower-cost experiences.

“Families are attending but are not spending money in the shop at the level they have done in the past. Shop spend is more likely to come from different demographics.”

Grandparents are playing a larger role in family visits, often expanding the catchment area of sites but contributing less to secondary spend. Some organisations are successfully adapting by enhancing free experiences, leveraging influencer marketing, and using word-of-mouth recommendations to drive engagement.

Pulse Monitor

Taking the pulse of the people who care for our shared heritage:

- Organisational survival confidence continues to improve

- Staff retention is stabilising, but stress levels remain high

- Financial uncertainty persists, but confidence is trending upwards overall

Confidence in the sector is steadily improving, with an average survival rating of 7.5/10. Respondents feel more assured in their organisation’s ability to navigate the next year and deliver their core mission. There is a small decrease in confidence that organisations can adapt to income and cost challenges, but this is still trending upwards.

Staff retention is showing positive signs, with 7.7/10 of respondents intending to stay at their organisation for the next year, a recovery from 7.1/10 in January 2025. Despite this, stress levels have climbed to 5/10, the highest since September 2024. Heritage professionals report strong confidence in their ability to care for collections and engage communities.

Survey Report (Family Visits)

This month’s research was a joint survey with Arts Professional, and across both organisations, 338 respondents completed at least one question.

The first section of the survey asked respondents about family visits, designed to check the temperature of this key audience, particularly changes observed over the Christmas period and into the New Year. Following this, respondents were questioned about changes they had seen in family spending behaviour and asked to share any successful strategies. The final section asked the Heritage Pulse panel members the monthly “Pulse Monitor” questions, which track the individual and organisational resilience of respondents.

Family visits

Organisations are pivoting towards events to attract families

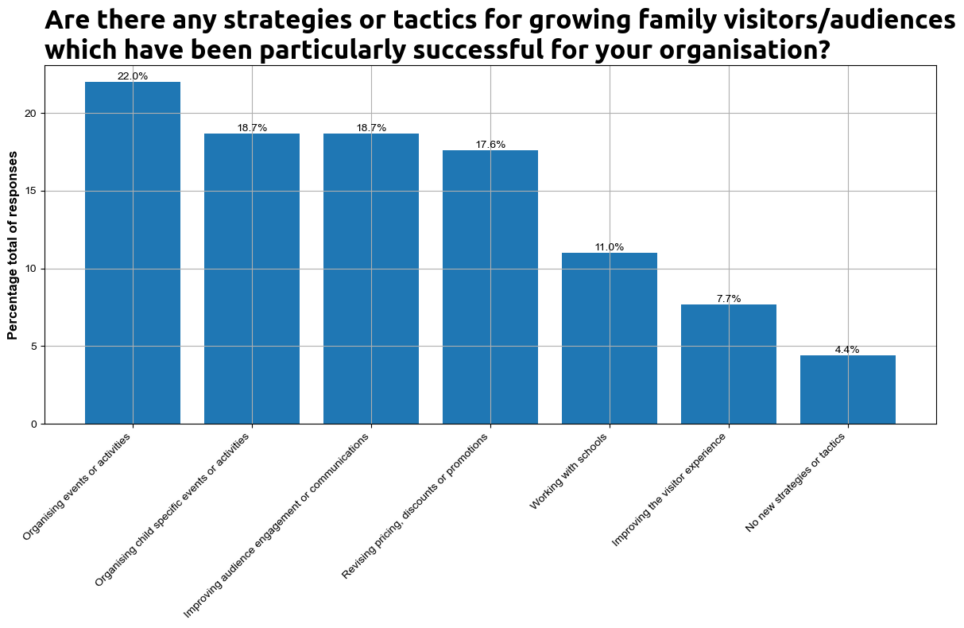

We asked respondents what strategies had been particularly successful at attracting families. We used a Large Language Model (LLM) to analyse and categorise these responses.

n=91

Four in ten respondents use events as part of their strategy to attract families, with one in five explicitly creating events to attract families with children to their site:

We made events drop-in, which are free and with no booking required. Activities are seasonally programmed and linked to our arts theme. By making under 5s areas welcoming and safe we’ve created social spaces for families to meet.”

Has the composition of family groups changed?

Some respondents noted the impact that grandparents had on attendance at their heritage site or arts venues.

A multidisciplinary arts venue in the North East of England said they had found grandparents were purchasing tickets as presents for younger members of their family. This meant that their catchment area had increased as families visited from further afield. However, this came at a cost for them as families brought their own food, rather than spending at the on-site café.

A heritage site in the East of England found that while they had seen a decline in family tickets sold, attendance was higher for free events driven by grandparents bringing grandchildren to the site. While this increased attendance, this did not filter through to secondary spending once these families were on-site.

19% of respondents adapted their engagement and communications to accommodate families:

We found working with museum influencers has been wonderful in raising awareness about our activities and site. Aside from that, we noticed word of mouth has been highly effective, as we have found ourselves being the talk of local WhatsApp groups with many families joining us following recommendations from friends.”

18% utilised price, discounts or promotions aimed at families.

Do free-to-enter events impact secondary spend?

A heritage organisation in the South East of England ran a ‘kids go free’ event at their paid site, and as a result their free museum experienced higher footfall and an increase in secondary spend. More visitors have chosen to supplement their free visit to the site by choosing to take part in a paid activity.

Heritage sites target families through events, while arts organisations attract families through audience engagement and promotions

When segmenting for heritage and arts organisations, we can see different approaches to growing family audiences. The heritage sites that responded to the survey said they focused on events to grow their family audience:

“Providing hands on activities for all ages. Often the focus is all on children, but many older people want an interactive experience as part of their visit.”

Arts organisations on the other hand focused on communications and pricing to attract families, with some evidence from survey respondents that these organisations are more sensitive to changes in spending than heritage sites:

“We reduced the price of activities and tickets to create affordable family packages”

Signposts

Read our latest blog post for great examples, case studies and recommendations for engaging families

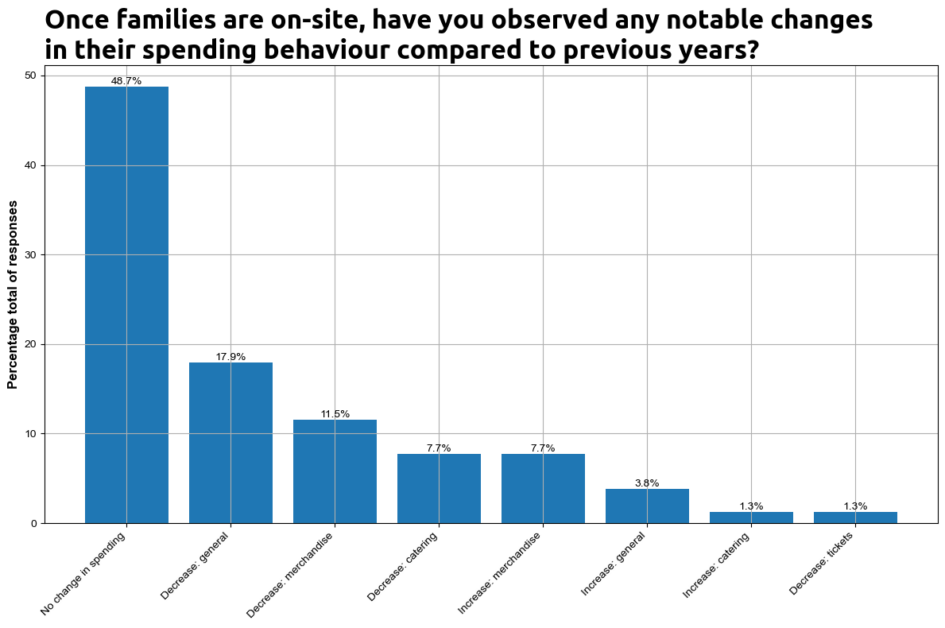

Changes in family spending had a differential impact on respondents

n=78

While half of responses did not observe a change in family spending behaviour, other respondents could identify areas where spending by families had fallen. One in six respondents saw a general decline in spending by families:

“When families are on site, they rarely spend any money at the museum but may buy items at the community shop next door. Spending patterns are lower than in previous years.”

“Virtually no secondary spend. Donations have also fallen to an all-time low at our free events and activities.”

Have ‘free’ sites observed a reduction in family spending?

A heritage site in the West Midlands runs a series of activities aimed at families that are growing in popularity. These are free, with the site asking for a contribution if visitors can donate. They observed a general increase in spending by families on-site, commenting that this was driven by donations which had increased in line with their growing attendance.

One in ten observed a decline in sales of merchandise, observing that:

“Families are attending but are not spending money in the shop at the level they have done in the past. Shop spend is more likely to come from different demographics.”

“Families don’t spend much in our commercial areas, particularly the shop.”

How have respondents adapted their offer to changes in family spending?

A performing arts venue in the East of England increased their secondary spend amongst families, despite a strategic focus on the price of their event.

They found that while families were very price sensitive to perceived offers, they were able to increase family spending by adding additional value to their events through ‘meet and greet’ sessions or book signings.

Read More

The Family Arts Campaign support and champion the people and organisations that bring fantastic creative provision, events and initiatives to life across the UK.

A mixed Christmas 2024 for attendances

We asked respondents to compare Christmas 2024 with previous years, and whether they had noticed a change in family attendance. 42% of respondents saw no change, 26% saw a decrease and 32% observed an increase (n=127).

Where respondents had seen a change, they were prompted for any additional context:

“Funds are tight for families on low incomes, hence them not prioritising many arts and cultural activities as part of their Christmas budget.” [Slightly decreased attendance]Larger organisations prioritise regular reporting on their impact

“We targeted an increase in family attendance by putting on more age-appropriate shows and pricing competitively.” [significantly increased attendance

Attendances are up at the beginning of 2025 compared with the end of 2024

Respondents are reporting a more positive start to the year. While 24% report a decline in family attendance, 37% of respondents observed an increase compared to the end of 2024 (n=128).

We also asked respondents if there was any additional context that may help explain the changes they had witnessed.

“Footfall overall was down by 12% on the previous year, but numbers of children within that reducing by 2%. We think largely due to the economic climate, and a city with high deprivation scores.” [Slightly decreased attendance]

“We always felt that families were quickest to return after Covid and we pride ourselves on offering a rounded experience that isn’t just about seeing a show. That, coupled with an ace marketing team, has resulted in this last year being our best audience attendance.” [Significatnly increased attendance]

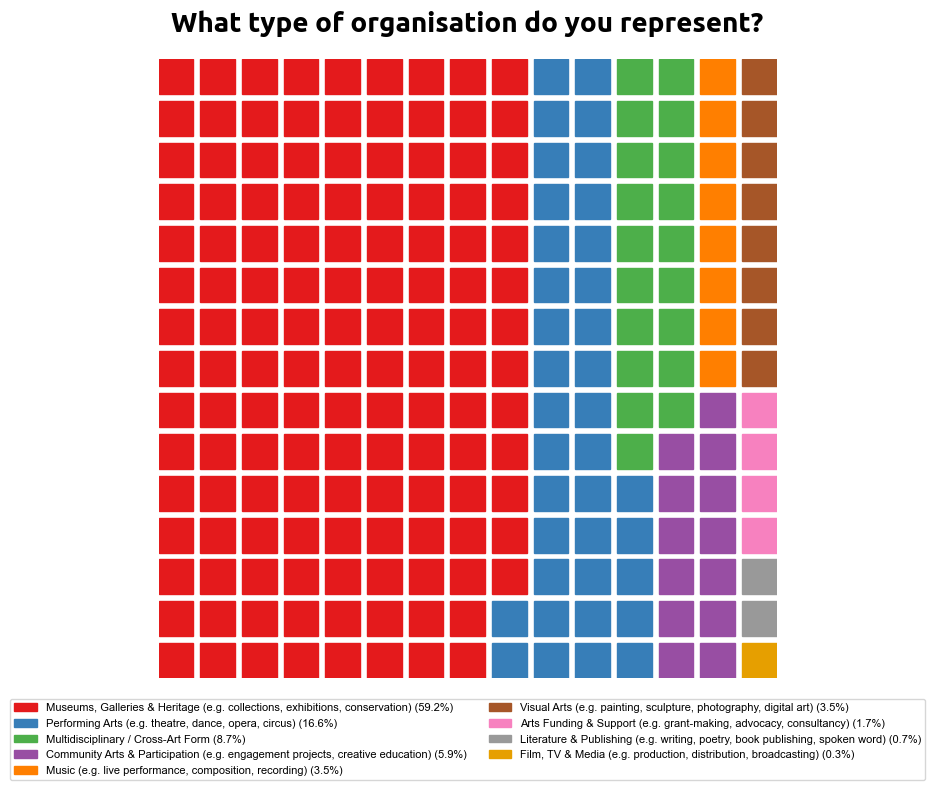

What is the profile of the organisations that responded to the survey?

n=513

60% of responses to the survey were from museums, galleries or heritage sites, with the remainder coming from across arts organisations. Despite overall survey engagement, demographic questions saw a lower completion rate, potentially limiting the representativeness of our analysis.

Pulse Monitor

Pulse Monitor is a monthly health check on the heritage sector, measuring the resilience and confidence of both people and organisations in the heritage sector. This set of questions was only directed to the Heritage Pulse survey respondents.

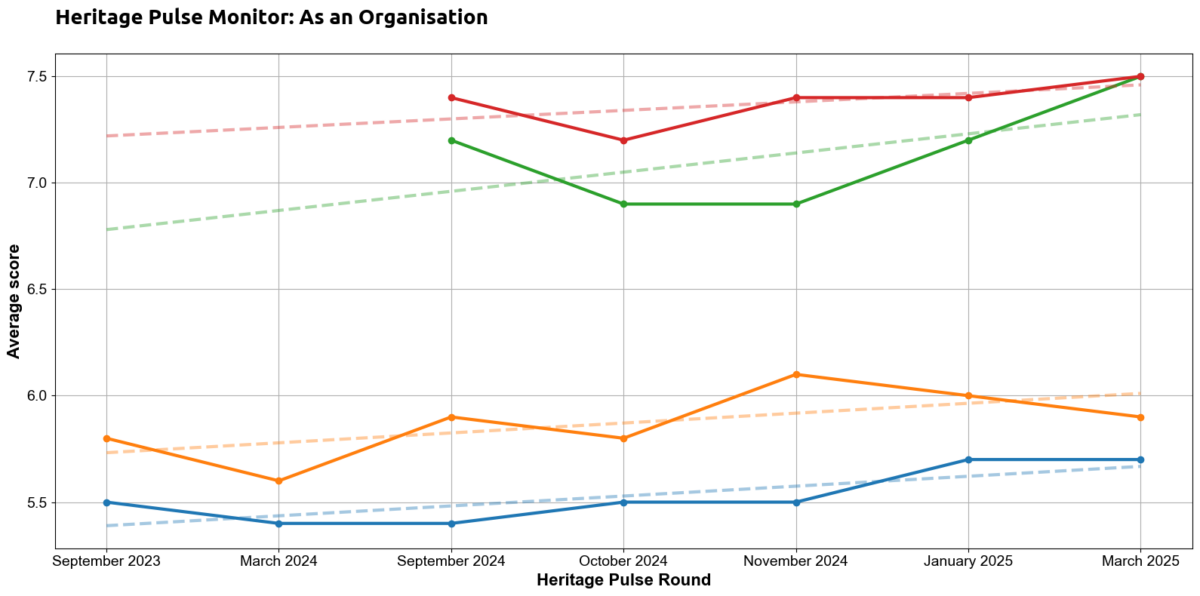

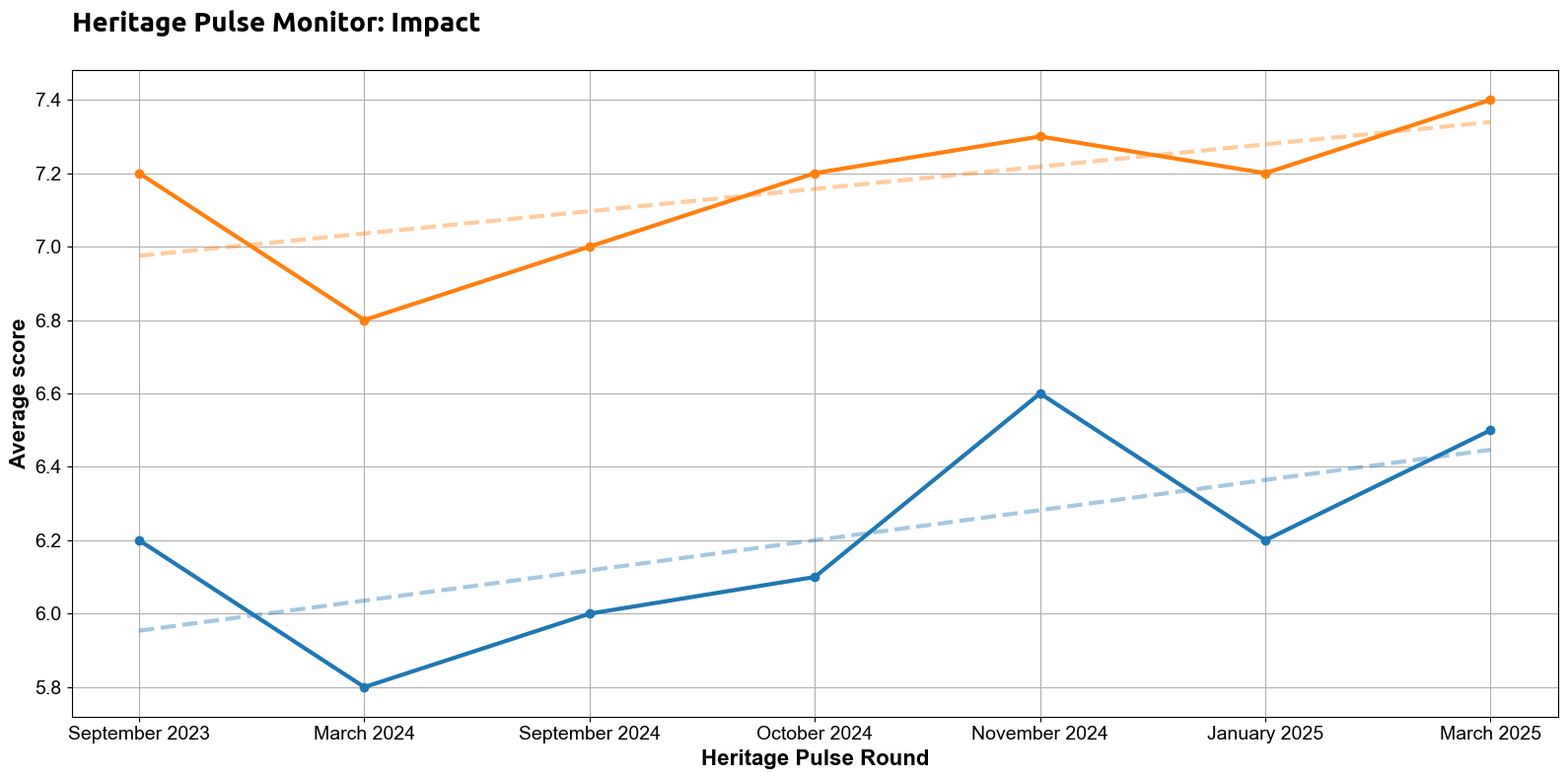

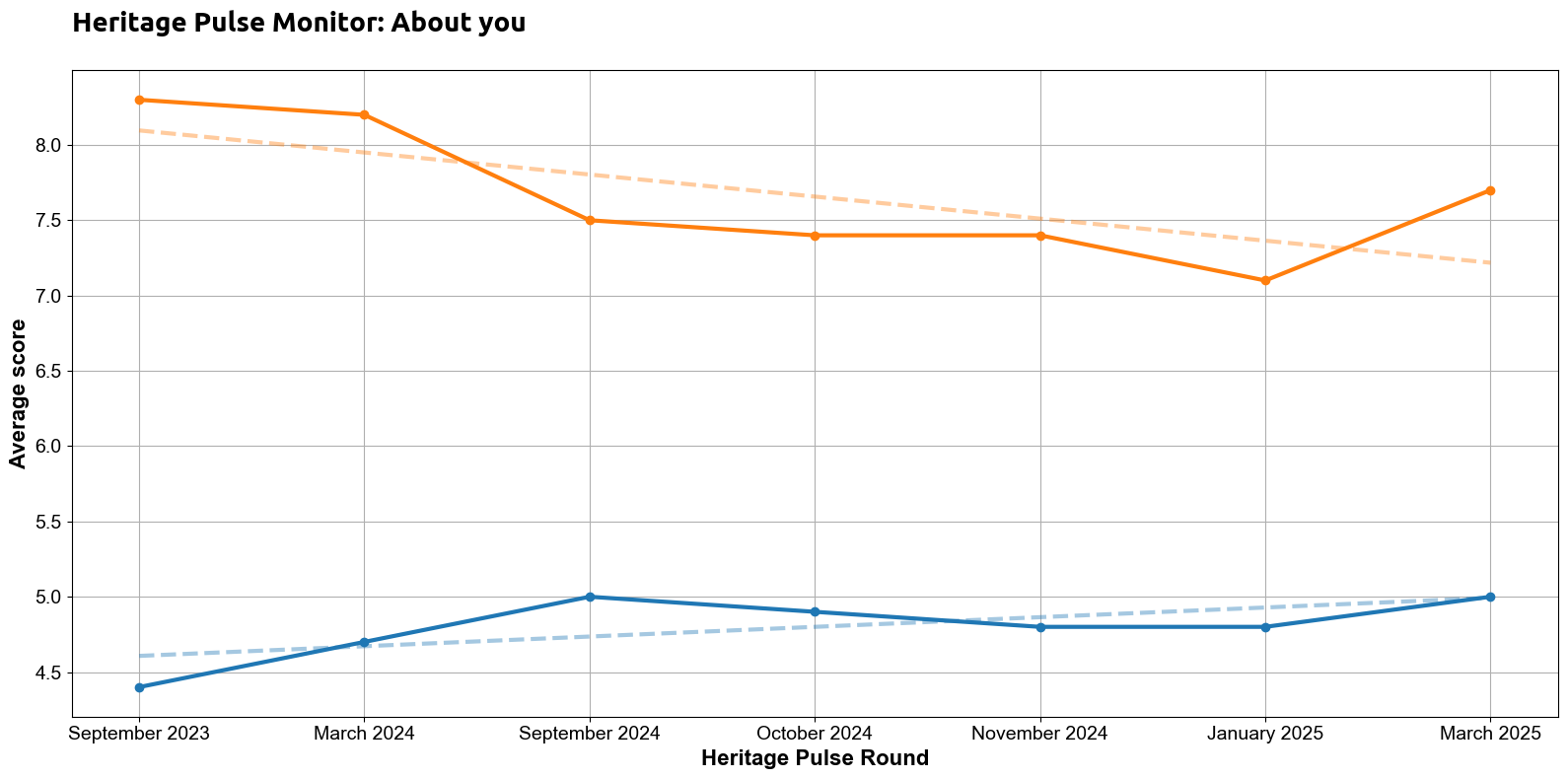

Panel increasingly confident about the coming year

106 panel members completed this question

Panel members’ belief that they will survive the coming 12 months increased to 7.5 / 10, drawing level with respondents’ understanding of their objectives.

Panel members’ ability to retain and recruit new volunteers / staff as needed remains at 5.7 / 10, matching January 2025. While there was a slight fall to below 6 / 10, respondents’ belief they can adapt to income and cost challenges remains on an upward trend.

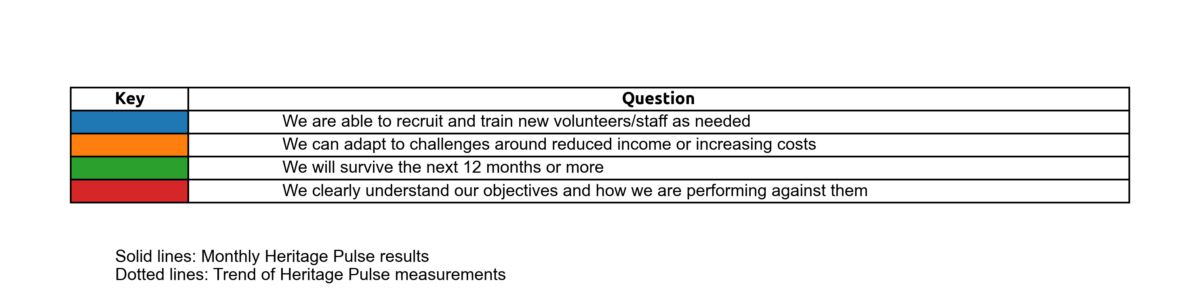

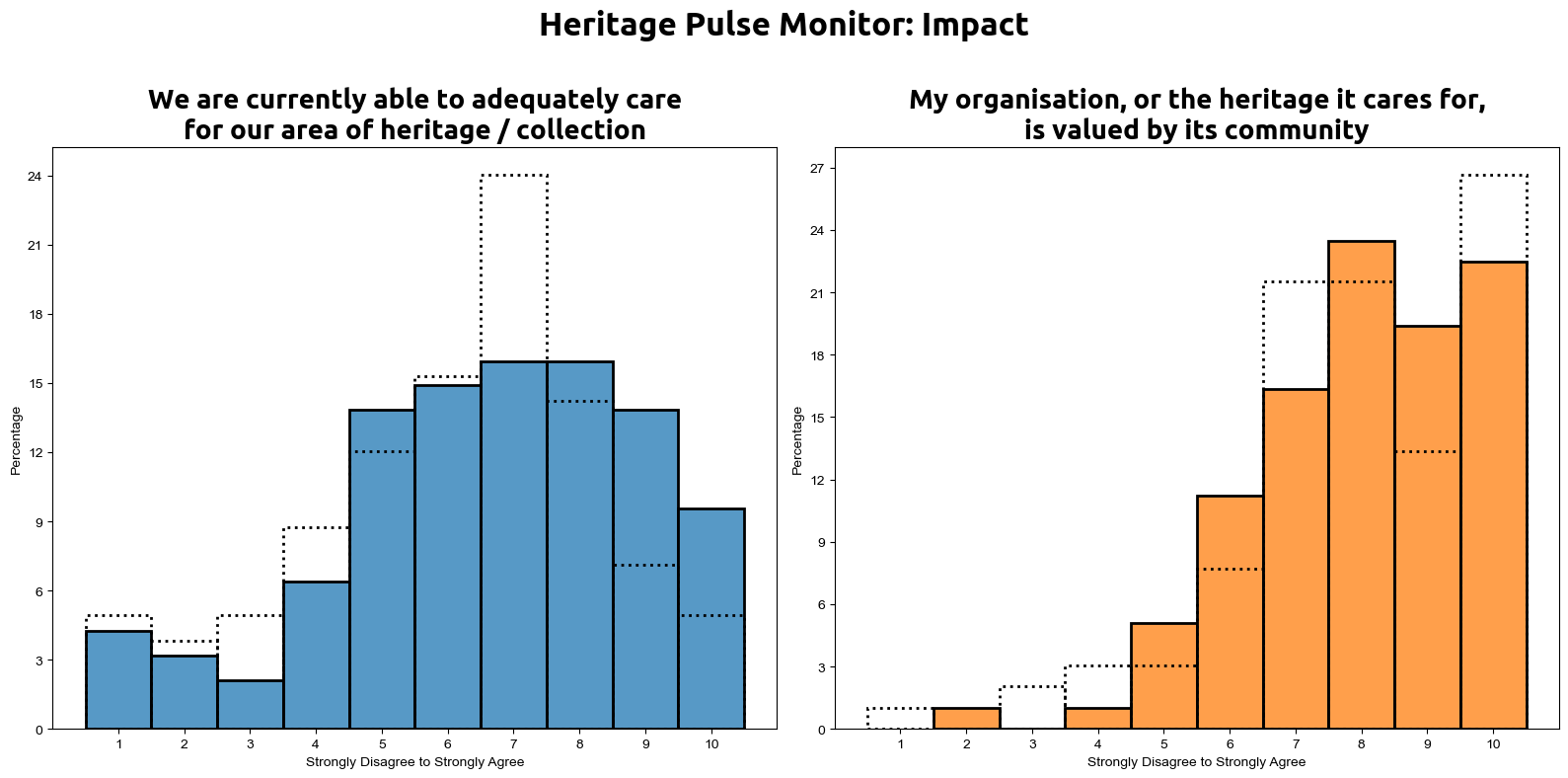

We can analyse the distribution of responses this month (in colour) compared to the previous survey (dotted outline).

More than a third of respondents scored 10 / 10 when asked about survival over the coming 12 months, and over 60% scored 8 or more out of 10 when asked about their understanding of objectives.

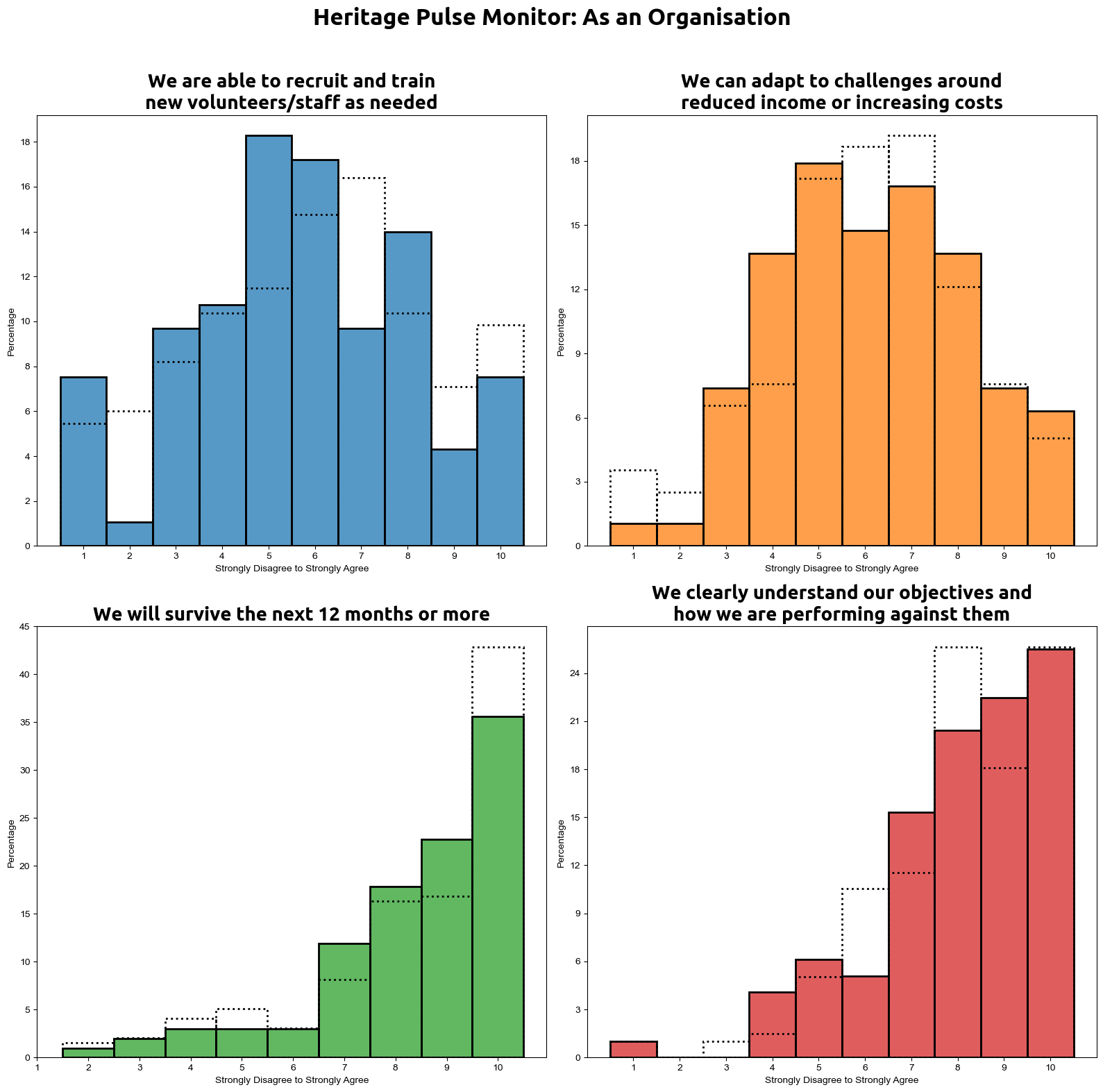

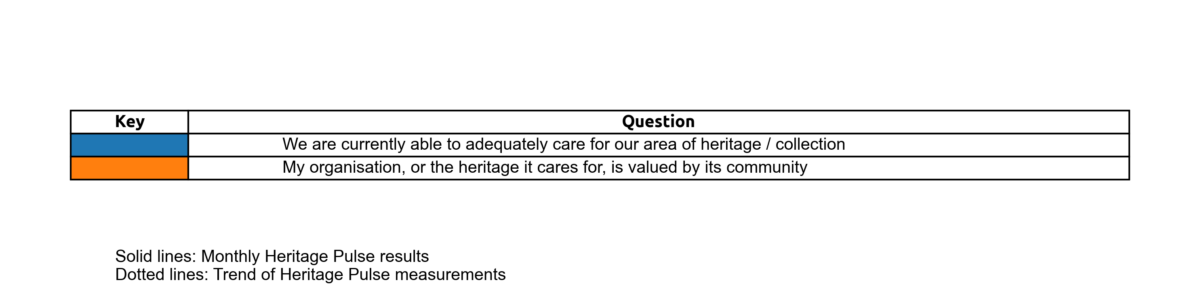

Panel’s assessment of their personal impact increases on January

104 panel members completed this question.

Respondents’ belief that they can adequately care for their collection / heritage, and that their work is valued by their community rebounded in March after falls in January – continuing an upward trend.

When looking at the ability of respondents to care for their heritage compared to January 2025, we can see that there was moderate disagreement, with responses clustered between 5 and 9 /10. By contrast, a more settled view remains among the panel when asked about the value of their heritage within the community.

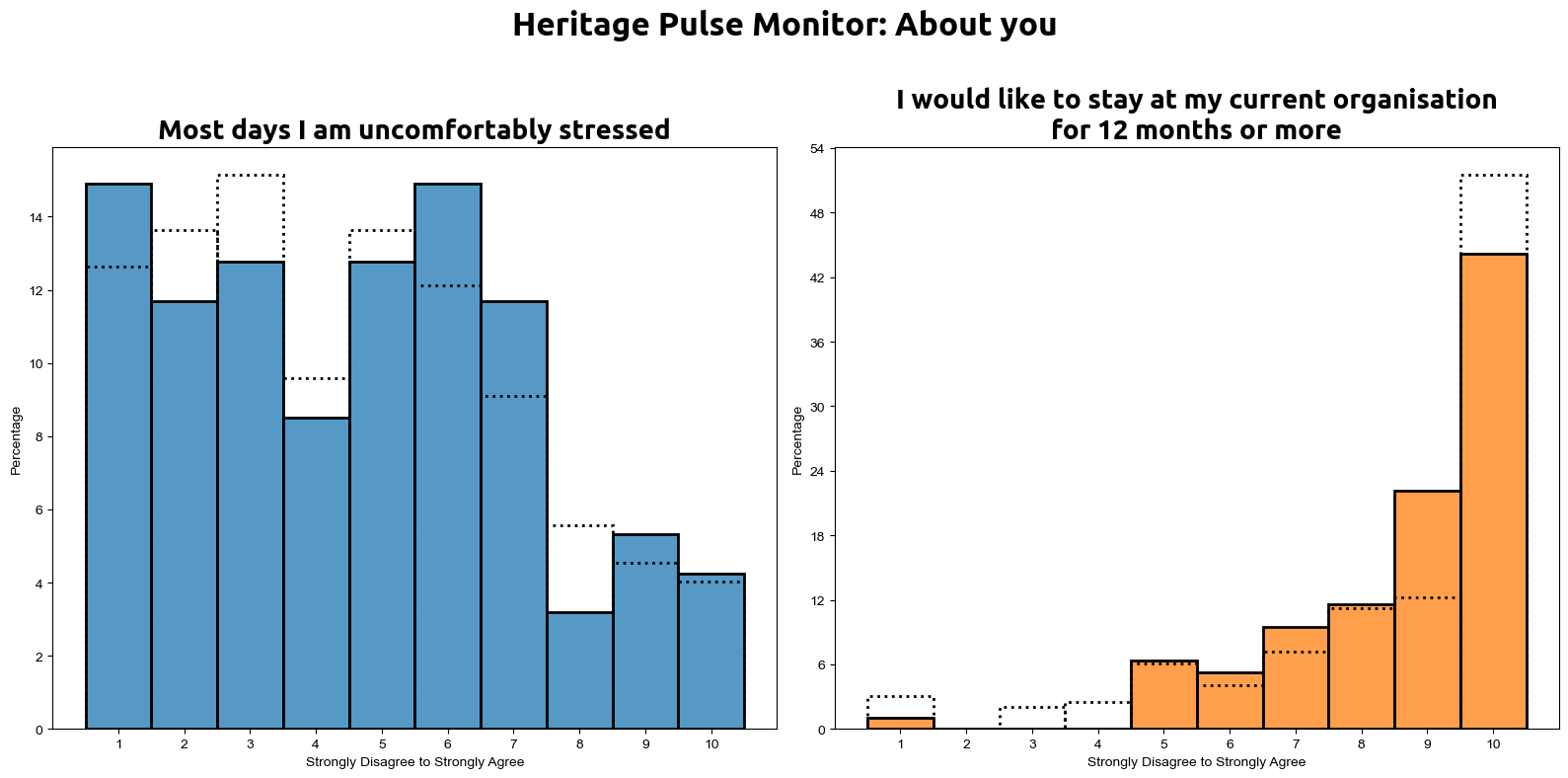

Respondents’ intention to remain at their current organisation recovers from January 2025

104 panel members completed this question

Panel members’ desire to stay at their current organisation for the following 12 months and beyond increased to 7.7 / 10, up 0.5 points on January and its highest score in the past 12 months. However, the reported stress of respondents continues an upwards trajectory, increasing to 5 / 10, the highest score since September 2024.

The distribution of responses in March was very similar to January 2025. When asked about whether they are uncomfortably stressed most days, we saw the largest dispersion of responses of any Pulse Monitor question, with almost 90% of responses scoring between 1 and 7 / 10 for this measure.

Almost half of panel members when asked if they would like to stay at their current organisation for 12 months or more responded with a score of 10 / 10, showing a positive outlook for a plurality of panel respondents.

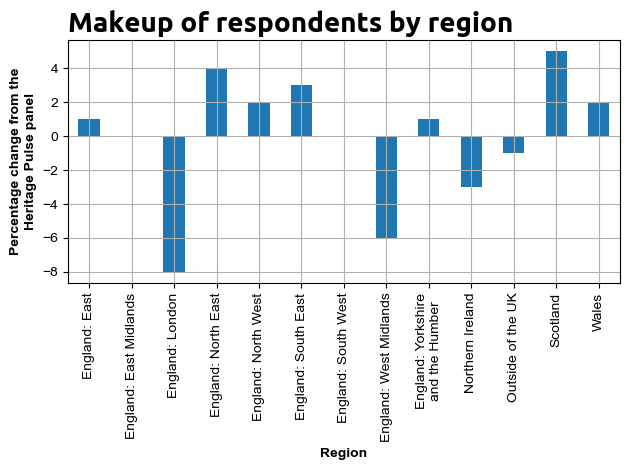

How representative of the Heritage Pulse panel were the March 2025 respondents?

Compared to the entire panel, respondents based in London were most underrepresented in this survey, 8 points lower than their overall total, followed by the West Midlands (-6) and Northern Ireland (-4). By contrast, panel members in Scotland were the most overrepresented, with the total proportion of respondents 5 points higher than their position in the panel, followed by the North East of England (+4).

ENDS

Pingback: Families ‘spending less’ during arts and heritage visits