Executive Summary

Over the next three months, UK Heritage Pulse is launching The Big Think — a sector-wide conversation shaped around three critical questions, one each month. Key findings from the May 2025 research, exploring the first of three Big Questions, “How can we build financial resilience and adapt our operating models to survive ongoing financial uncertainty?” show:

- Panel members embrace entrepreneurial thinking to help adapt to changing circumstances

- Longer-term, respondents are looking to innovate to help overcome financial challenges

- There is a hidden cost to fundraising that prevents some panel members from raising money effectively

- The first step for heritage organisations adapting to survive is a focus on why they exist and the users who benefit

Pulse Monitor

Taking the pulse of the people who care for our shared heritage:

- Respondents are increasingly confident that they can overcome cost and recruitment challenges

- While fewer panel members are finding their role stressful, respondents think they are less likely to remain in their current roles

Survey Report (The Big Think)

In May, a total of 181 UK Heritage Pulse panel members responded to at least one question.

This month we launched The Big Think – a sector-wide conversation shaped around three critical questions, one each month. Respondents were posed one Big Question, which they could answer by agreeing or disagreeing with a series of statements or sharing their own reflections.

This report will provide a provisional summary of the results for this month’s Big Question. In future rounds, respondents will be invited to complete any questions they have not already answered, with the results published at the conclusion of The Big Think.

The final section asked the monthly “Pulse Monitor” questions, which track the individual and organisational resilience of panel members.

Immediate Survival and Adaptation

Panel members believe that entrepreneurial thinking and investing in innovation are key to the survival of the sector

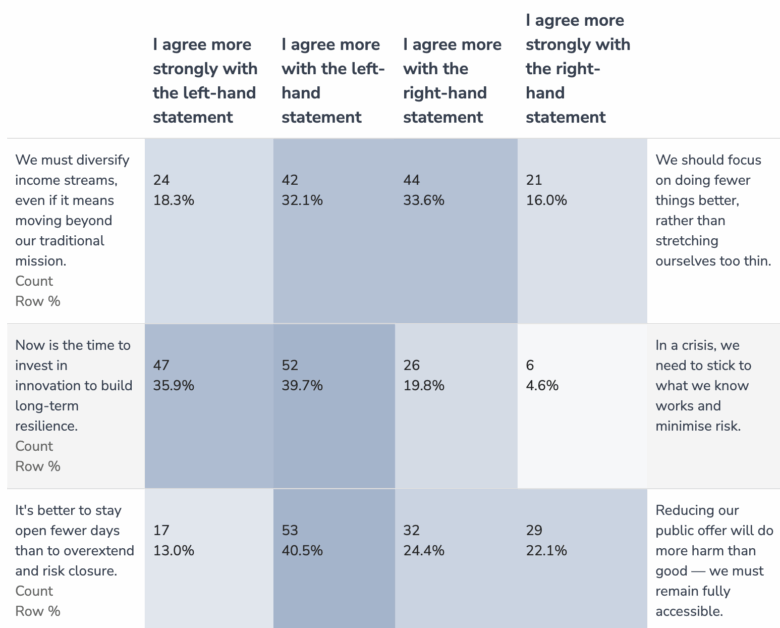

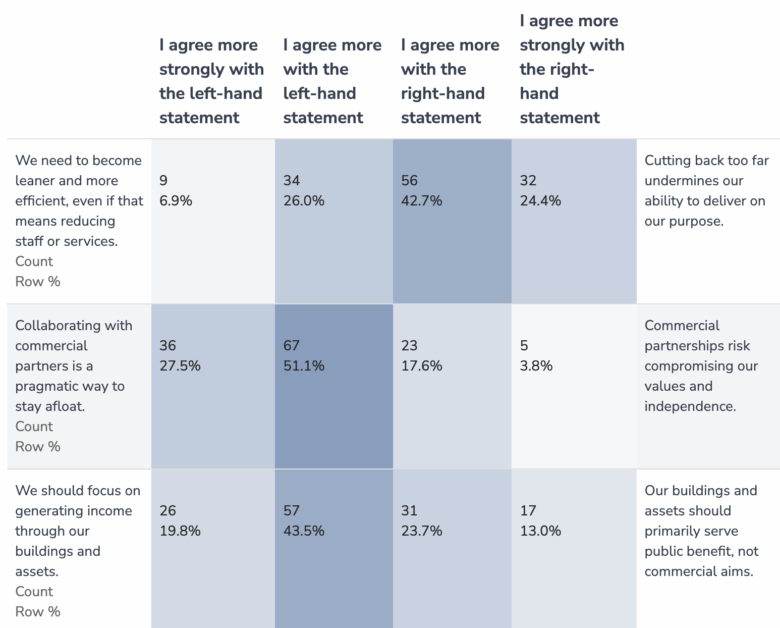

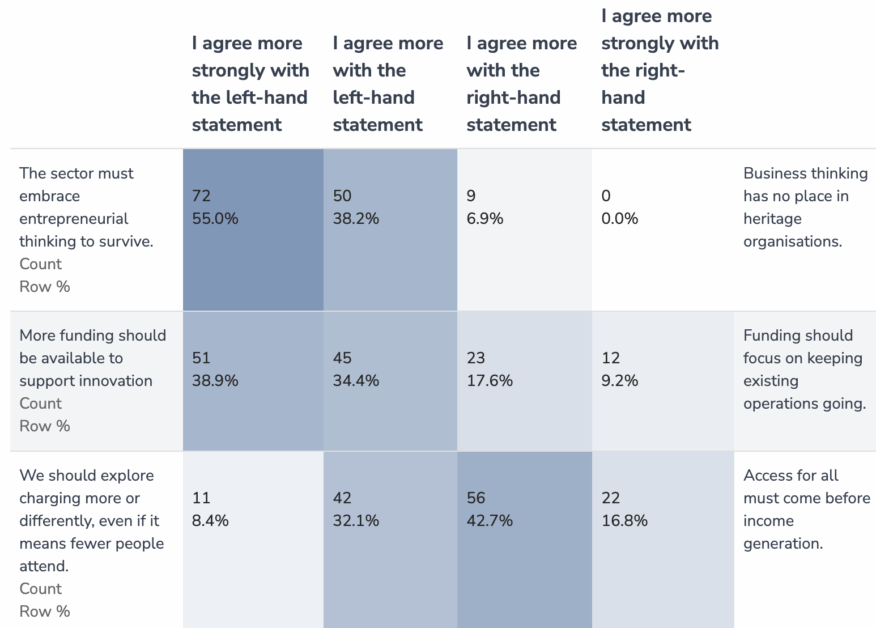

We asked panel members a series of thought-provoking yet contrasting statements, asking them which opinion they found more persuasive and the strength of their agreement. This was measured along a four-point scale, and the full results are further down this page.

The panel (n=131) strongly believe that:

- The sector must embrace entrepreneurial thinking to survive: 1.52 / 4, versus “Business thinking has no place in heritage organisations”)

- Now is the time to invest in innovation to build long-term resilience: 1.93 / 4, versus “In a crisis, we need to stick to what we know works and minimise risk”.

There was a preference amongst respondents that:

- More funding should be available to support innovation

- Collaborating with commercial partners is a pragmatic way to stay afloat

- Cutting back too far undermines our ability to deliver on our purpose

- Access for all must come before income generation

- We should focus on generating income through our buildings and assets

- It’s better to stay open fewer days than to overextend and risk closure.

The panel was undecided whether heritage organisations must diversify income streams, even if it means moving beyond their traditional mission; or whether they should focus on doing fewer things better, rather than stretching themselves too thin. However, when segmenting for voluntary organisations, they believe there should be a focus on doing fewer things better.

How can we build financial resilience and adapt our operating models to survive ongoing financial uncertainty?

n=131

“It doesn’t necessarily mean making money, it means a better way of doing things” – respondents’ are making their organisation’s income go further

Following the statements, panel members were invited to give any additional comments. Respondents commented on the importance of extracting as much value from their income as possible. Examples of action taken include increasing the number volunteers enlisted and reducing running costs, while refocusing on their organisation’s core offer to users.

“Beat at the heart of the community” – panel members believe resilience starts in your locality

For those that did not want to complete the statements, panel members had the opportunity to respond directly to the Big Question.

Respondents’ reported that their main concern is raising enough income for their organisarion, and expressed frustrations with the current model of fundraising, particularly the secondary costs incurred when raising money:

“It sounds silly but we cannot afford the cost of fundraising. It means paying a fundraiser to do the job and even with the help of volunteers all the funds that are raised do is pay the cost of the fundraiser.”

“Currently, as a sector, all too often we separate “income generation” and “fundraising”, with one being seen as being driven by commercial aims and with a potentially negative alliance with an organisation’s values.”

In spite of those concerns, panel members identified that a successful way to build resilience was to focus on why their organisation existed, and the local users who benefit:

“Small charities beat at the heart of our community. They are concerned with people and places at a local level. They have local community knowledge and they arise because a problem is not being addressed.”

“We need to develop people first strategies that support long-term people focused operations and outcome.”

Read more

The National Lottery Heritage Fund provides organisational sustainability and resilience good practice guidance, which can be read here

Pulse Monitor

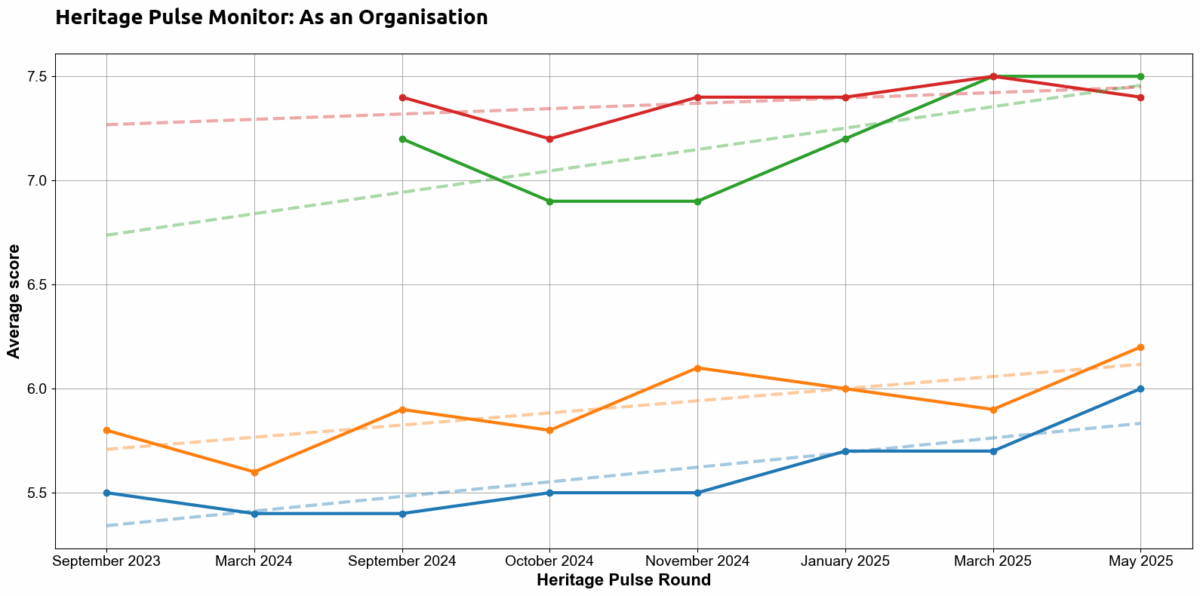

Pulse Monitor is a monthly health check on the heritage sector, measuring the resilience and confidence of both people and organisations in the heritage sector. This set of questions was only directed to the Heritage Pulse survey respondents.

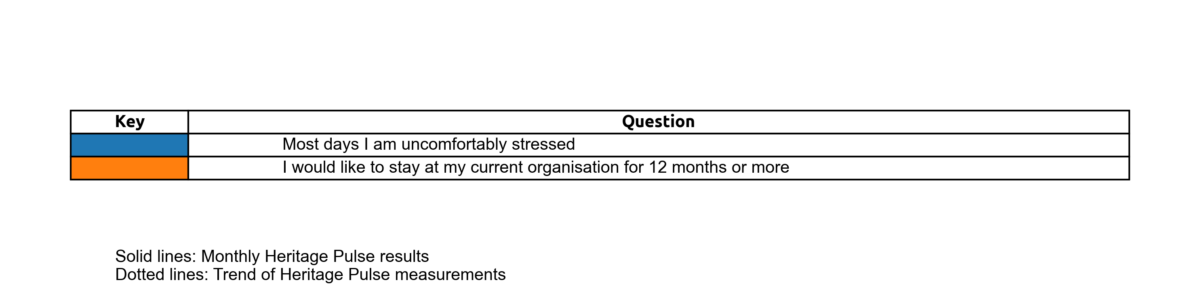

Panel members increasingly believe they can overcome cost and recruitment challenges

117 panel members completed this question

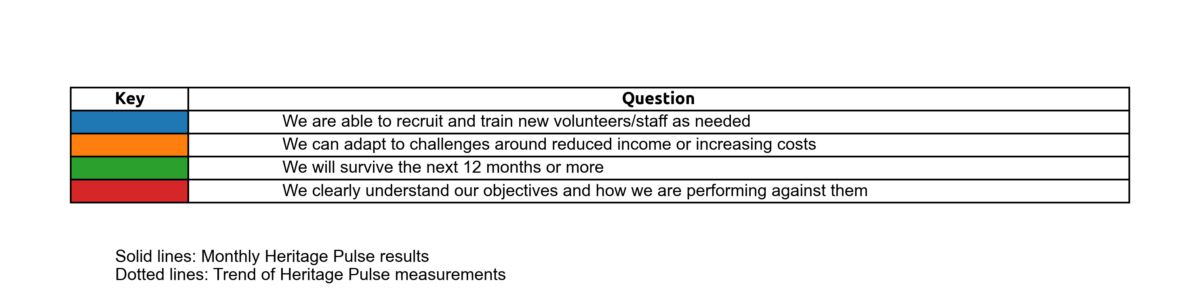

Panel members’ ability to retain and recruit new volunteers/staff as needed recorded its highest score in Heritage Pulse of 6 / 10. Respondents’ ability to adapt to income and cost challenges also increased to 6.2 / 10, a new high score for this measure.

Respondents’ belief that they will survive the coming 12 months remains stable on March 2025.

We can analyse the distribution of responses this month (in colour) compared to the previous survey (dotted outline).

More than half of respondents scored 10 / 10 when asked if they will survive the coming twelve months, the narrowest distribution of responses in this round of Heritage Pulse.

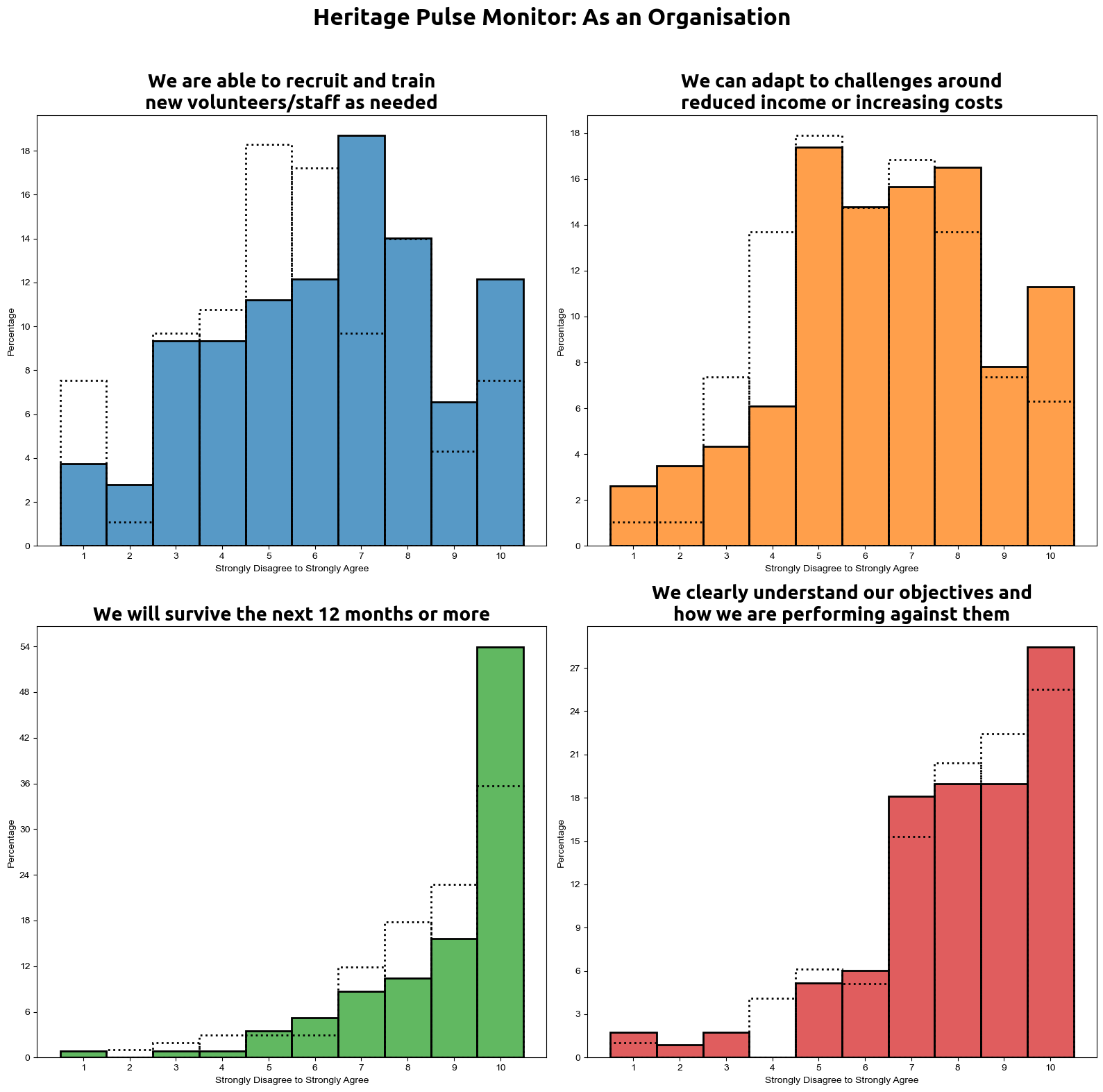

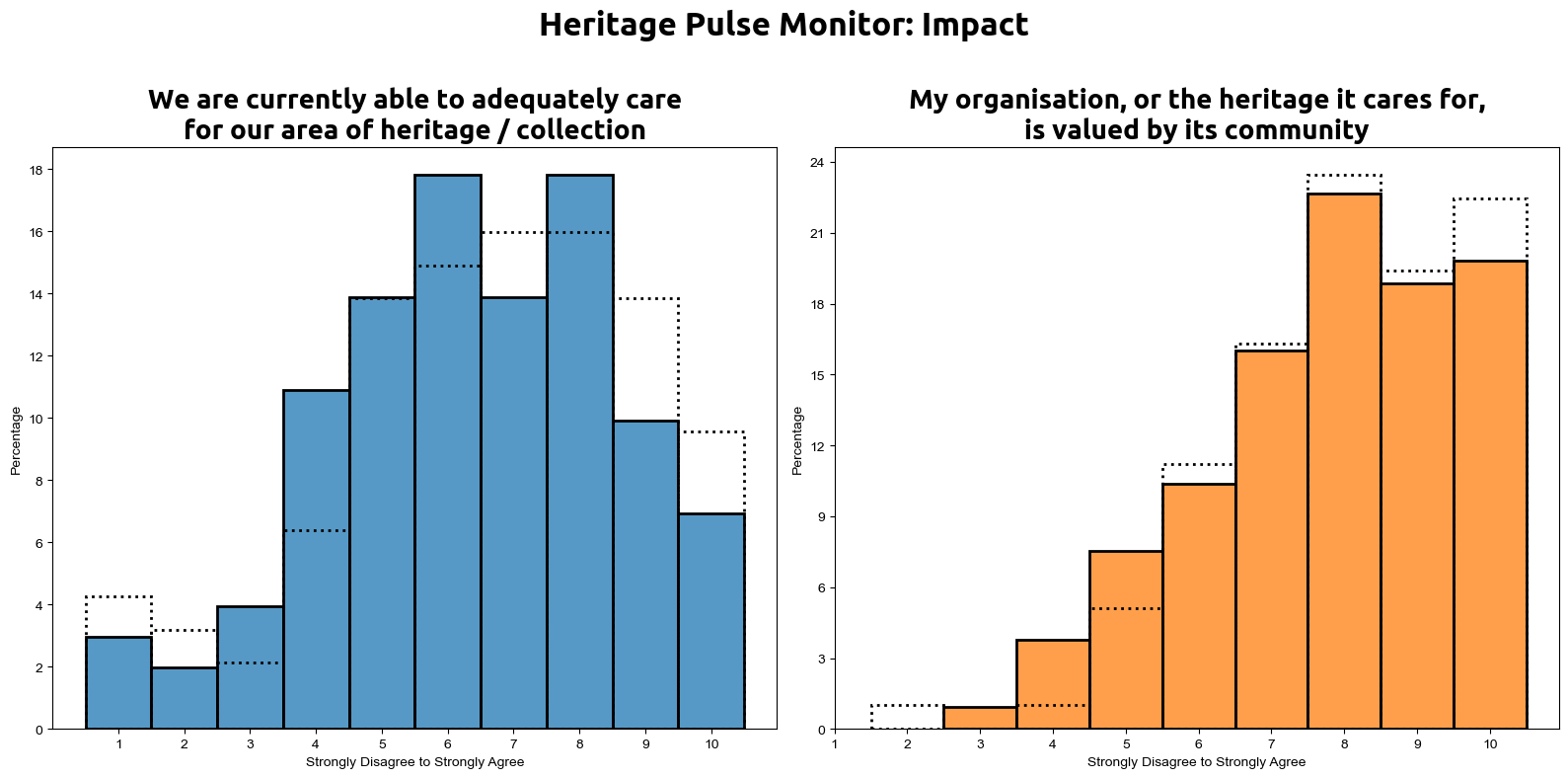

Despite positive trend, respondents’ assessment of their impact falls

117 panel members completed this question.

Respondents’ belief that they can adequately care for their collection/heritage and that their work is valued by their community saw slight falls from March, however, both measures continue to trend upwards.

When looking at the distributions compared to March 2025, while there was a fall in the mean value for respondents’ belief that their heritage is valued, more than two-thirds of respondents gave a score of 7 or above for this measure.

When asked whether they can adequately care for their area of heritage/collection, we can see a shift to scores ranging between 3-6 / 10 this month.

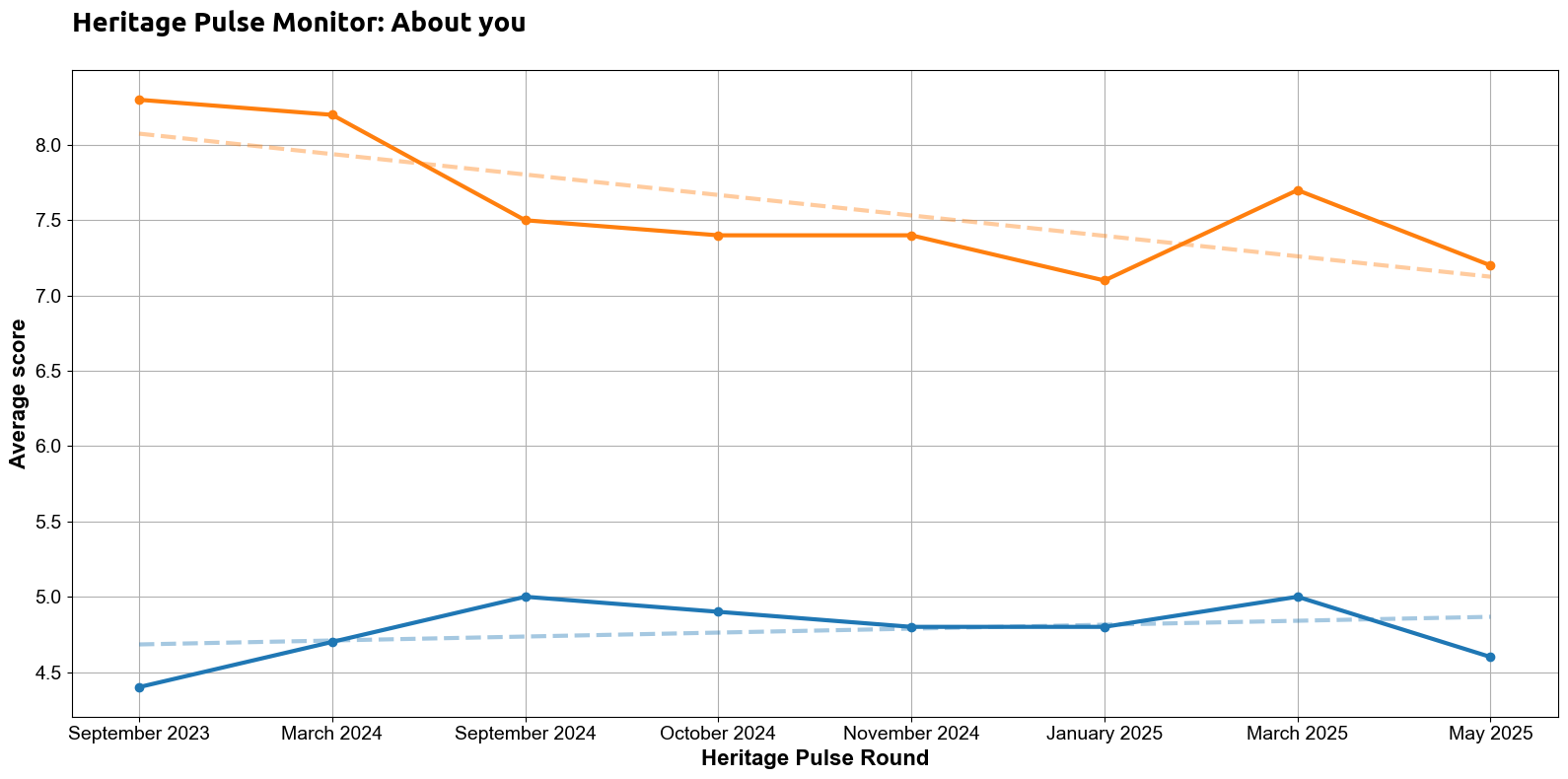

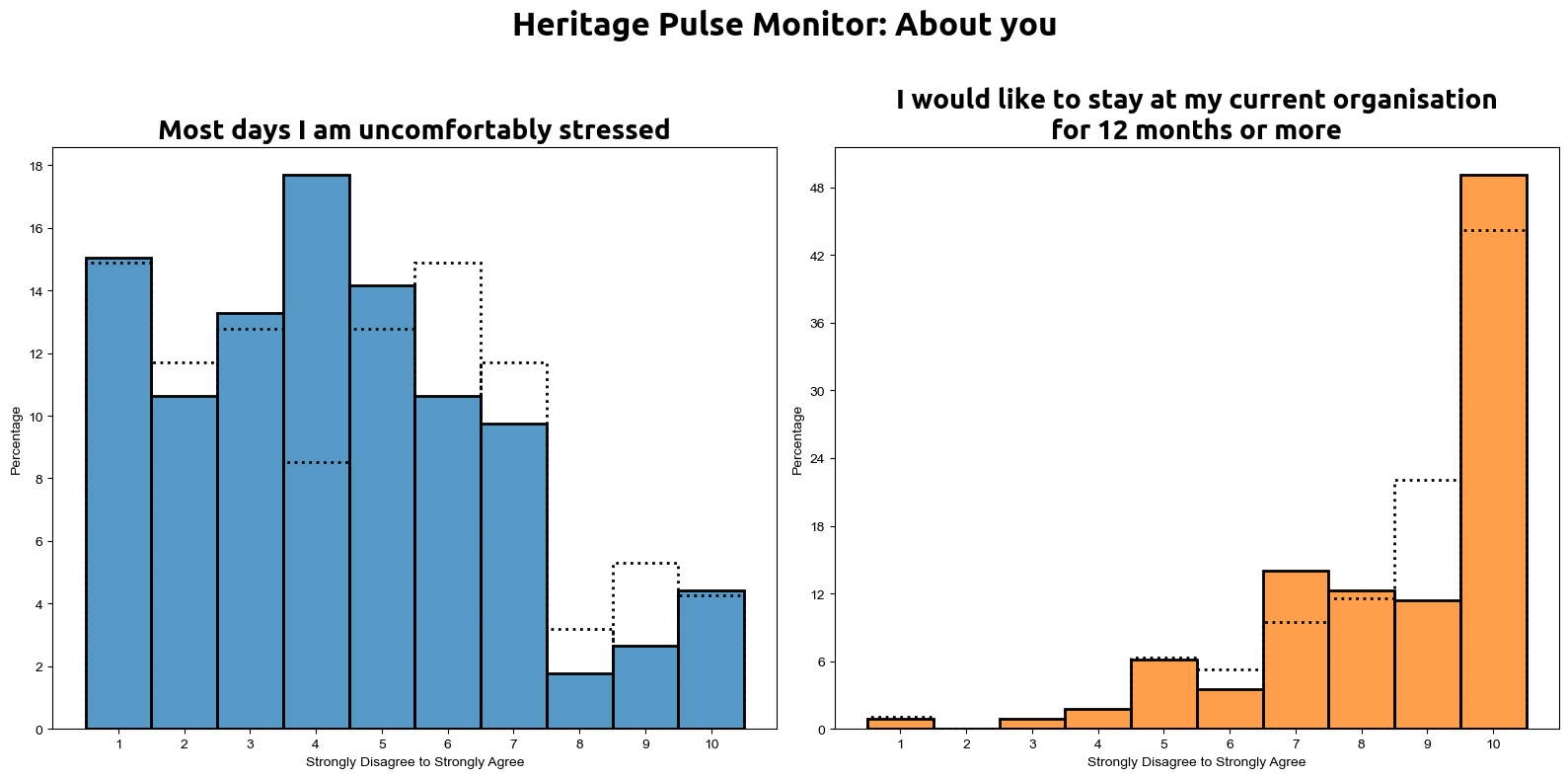

Fewer respondents want to stay at their current organisation

117 panel members completed this question

Panel members’ desire to stay at their current organisation for the following 12 months and beyond fell to 7.2 / 10, back to the level last seen in January this year. The reported stress of participants fell to 4.6 / 10, the lowest score since the beginning of Heritage Pulse in September 2023.

Around 50% of respondents scored 10 / 10 for their desire to stay at their current organisation. This shows a varied experience across the sector and is consistent with the distribution from the last survey in March.

How representative of the Heritage Pulse panel were the May 2025 respondents?

Compared to the entire panel, respondents based in the North East and South East of England were the most overrepresented in this survey (plus four percentage points), compared to their position within the panel. By contrast, panel members in Scotland and Northern Ireland were the most underrepresented, with the total proportion of respondents three percentage points lower than their total in the panel.

ENDS