Each month, we’ll choose a particular cut of responses to take a deeper dive into. For February 2023, we decided to look at staffed organisations whose total staffing is between one and nine employees.

This data does not include volunteer organisations, who we will focus on in March. We have included only those respondents who fully completed the survey. As may be expected, organisations with fewer staff also have smaller financial turnover overall – most respondents in this data turn over less than £250,000 per year.

68 (48%) of the staffed organisations responding had between one and nine staff, with 75 (52%) having 10 or more staff members

🔍 Click on any chart to zoom in.

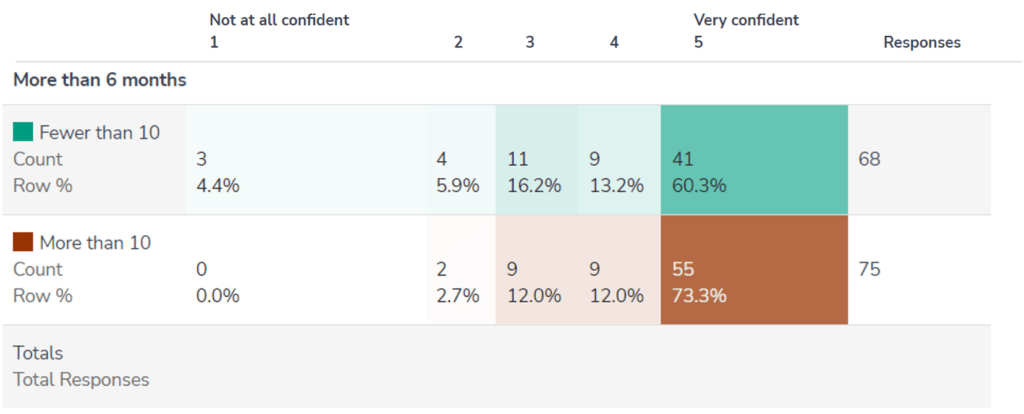

Organisations with smaller staff teams are somewhat less confident of surviving more than 6 months

When respondents were asked on a scale of one to five how confident they are that their organisation will survive more than six months, 60% replied “very confident”, which is 13 points lower than organisations with 10 staff or more.

But smaller organisations find it a little easier to predict their financial future.

When asked on a scale of one to five (where one is “not at all confident”) how confident organisations were in predicting their financial future, respondents with fewer than 10 staff were slightly more likely to score a four or five (out of five) than their larger counterparts.

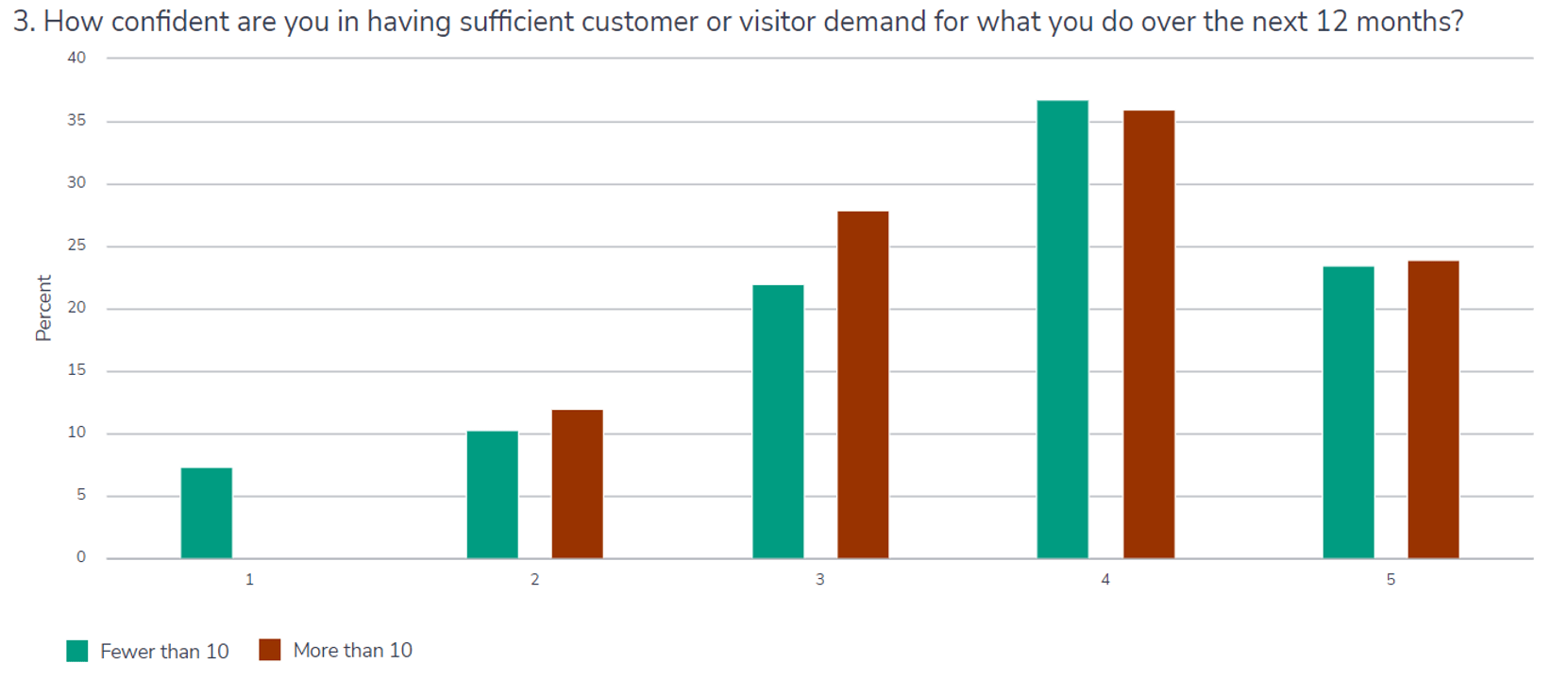

Expectations of visitor demand are consistent irrespective of organisation headcount

When asked “How confident are you in having sufficient customer or visitor demand for what you do over the next 12 months?”, 60% of organisations chose a score of four or above irrespective of their staff headcount.

Smaller organisations are notably less likely to make medium term investments.

Cost pressures are significant, and places of worship were particularly likely to reference heating costs:

Utility costs and fuel costs could break us, as it is unlikely that we can pass on such increases to customers who are also suffering increased pressure on their disposable income.

Cost of heating is a nightmare. We on a fixed rate deal that was £2k a year (10% of income) now over £8k (no sig change in income) and this is supposed to be such a good deal that we get no Gvt grant!! Just the standing charge for gas is over £2k/year even if we use no gas at all. We are small church signed up to [redacted] through Parish Buying and NOT impressed with the negotiated deal.

Life has been different because of raising fuel costs the church is very expensive to heat. We have been having our church services in a very echoey church hall. Our church is growing and we are almost at capacity in the hall. We have a good set of volunteers. We are a popular venue for all sorts of activities including orchestras, art exhibitions and lectures. We are looking to improve our foot fall for the community by increasing the number concerts during 2023

A mixed picture emerges for advisors and B2B sole traders

Some of the smaller respondents are advisors or other traders who do not directly manage heritage. Reflecting on the autumn and winter of 2022/23, their comments reveal a mixed picture:

Because we run a tight ship and are realistic about our product and market we have done relatively well

Extremely busy as projects that have been delayed by the pandemic are all rushing to be finished by the end of this financial year. Period after March is much quieter, partly because we need to rest and consolidate after such a crammed and overburdened period

Better than expected – due to more demand from clients and more opportunities coming forward.

I’ve had to accept a much lower day rate just to get work…which affects my confidence as well as my bank balance, but it is at least money coming in, even if it’s not very much…

Autumn and winter have been good and very busy as most contracts in the sector are let early autumn with an end of F/y deadline. Late spring and early summer are the most challenging for cash flow

It has been noticeable that business and public customers have reduced spending, significantly and this has had an adverse effect on our income since September.

Smaller organisations are somewhat more reluctant to increase prices

There are indications that respondents are seeking to absorb cost increases and avoid passing them on. Costs have risen in line with the headline data, but 47% of smaller organisation respondents said they would “not change” the prices they set for products/services they supply, compared to 31% of large organisations.

What is your reaction to these results? Please let us know at hello@insights-alliance.com, or share on social media with the hashtag #UKHeritagePulse