Results from September 2023 Panel Research

In September 2023, 270 UK Heritage Pulse panel members responded to a short survey on how the summer season had been for their organisation. The first section of questions explored organisational confidence and their place within the sector through a set of updated ‘tracker’ questions, while the second allowed respondents to reflect on April – August 2023 in comparison to the year prior.

Section 1: Taking the temperature of the sector

In this round of UK Heritage Pulse the longitudinal ‘tracker’ questions, which the panel are invited to respond to at regular intervals, were updated. This month establishes a baseline for the new tracker questions.

Organisational resilience

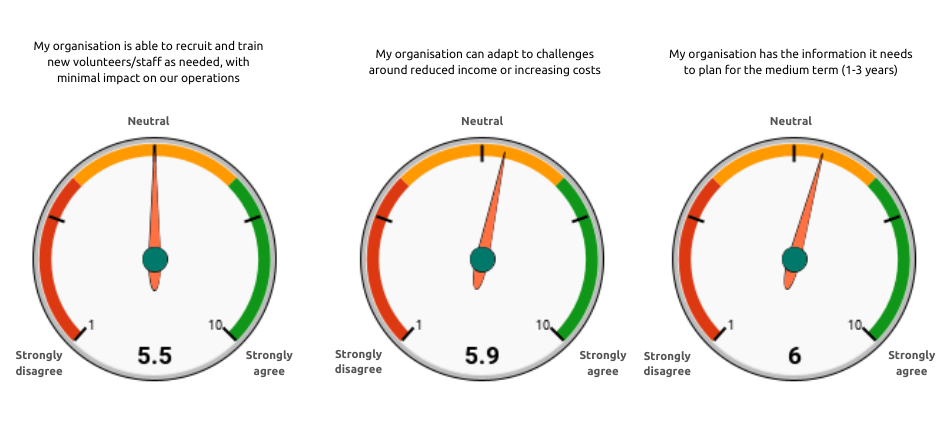

A mixed picture emerges, with responses showing a lack of confidence over adapting to financial challenges, planning for the future and recruitment.

How far do you agree or disagree with the following statements?

- Only 39% of respondents said their organisation was currently able to recruit and train new volunteers and staff as needed with minimal impact on their operations. Almost the same proportion – 38% – disagreed with this statement.

- 42% agreed they could adapt to challenges around reduced income or increasing costs.

- Half of respondents agreed with the statement ‘My organisation has the information it needs to plan for the medium term (1-3 years)’ and 1 in 4 disagreed.

Individual resilience

The majority of respondents want to stay at their current organisation for more than a year and feel able to adapt to unexpected change.

How far do you agree or disagree with the following statements?

- 63% of respondents said they would be able to adapt to unexpected changes in their working / volunteering life.

- 80% agreed that they would like to stay at their current organisation for 12 months or more. However, 1 in 4 said they were uncomfortably stressed most days.

- Respondents in a leadership role were more likely to say that they would like to stay at their current organisation for 12 months or more, despite being slightly more likely to express that they are uncomfortably stressed during most days in their role.

Impact and opportunity

Respondents feel their organisation and heritage area is valued by society and respected by the sector – but there is some concern for the future.

How far do you agree or disagree with the following statements?

- Nearly 80% agreed that their organisation, or the heritage it cares for, is valued by the wider society.

- 75% felt their organisation is respected by the sector. Leadership teams felt able to agree to this more strongly than wider staff respondents.

- 57% agreed that their organisation is able to adequately care for its area of heritage or collection, while 22% disagreed. Organisations with more than 10 staff were more polarised on this compared to those with fewer than 10 staff, with 67% agreeing but 24% disagreeing.

- 65% are confident about the future of their organisation.

- Overall, smaller organisations (both in terms of staff and annual turnover) were more likely than larger organisations to agree that their work is valued by wider society and respected by the sector, but larger organisations are more confident in the future of their organisations.

Section 2: How did this summer compare?

Respondents were also asked a series of questions in which they compared their organisation’s performance this summer with last summer, in areas including visitor figures, income, expenditure and online performance.

Respondents reported an increase in visitor demand and support in comparison to last year

- 52% of respondents saw at least some increase in their total visits / demand, and 53% saw an increase in the demand for education and community activities at their organisation.

- Half of respondents said they’d seen an increase in the acquisition of new members, supporters, or friends. The retention of these members, supporters or friends has remained relatively unchanged.

- Smaller organisations (those with a turnover of under £1m per year) reported significantly more of an increase in total visits compared to larger organisations (those with turnover over £1m per year) perhaps due to a slower recovery from Covid in 2022. They also reported more demand for educational/community activities and greater acquisition of new friends/supporters.

“Demand for family activities has been high throughout the summer.”

“Generally visitor numbers have been slightly down over the summer. Certainly not the year on year increase we were working towards. The unpredictable weather has not helped outdoor events and activities.”

There was an increase reported in earned income, though donations and membership income remained static

There was a fairly positive picture about total income, with 54% saying they had seen an increase in overall earned income (including trading income) though 30% said this had decreased compared to last year.

- Almost the same proportion had seen an increase (37%) and a decrease (37%) in income from on-site sources and ticket donations.

- The majority of respondents said that income from memberships, friends or regular donations has remained unchanged (43%), while a third said it had increased and a 1 in 4 that it had decreased.

- Again, smaller organisations (those with a turnover of under £1m per year) reported more of an increase in total earned income and income from Memberships / Friends / regular donations compared to larger organisations.

“Despite challenging times, our cafes have pulled themselves around, got on top of costs and are in profit. Events income also met target early in the financial year.”

“Higher than anticipated revisits by people who have bought an annual pass.”

“One off unexpected large donations have offset a reduction in the numbers of people giving, allowing us to hit our donation target.”

There has been a significant increase in expenditure, with increase reported in energy costs and payroll

- Overwhelmingly, respondents reported an increase in energy costs, payroll, direct costs and other overheads when comparing April – August 2023 to the same period last year.

- Most significant were the increases in payroll and energy costs, with 23% and 25% respectively selecting there has been a ‘big increase this summer’.

“Higher cost of living has particularly affected lower paid staff and has made us think hard about salaries and wellbeing support.”

“[We have faced challenges] meeting the high core revenue costs resulting from our current restoration and repurposing project.”

“[We have faced the challenges of] rising costs, weather impacting on visitor numbers/footfall in cafes, tenants falling behind in paying rents, rising levels of arson/ASB.”

Respondents also reported some increase on engagement with digital channels

Larger organisations displayed greater consideration and feelings of worry towards the use of AI and how it might affect how people interact with them. Many within this group are seeking out training to expand their knowledge in preparation.

- 74% or respondents had seen an increase in social media followers when comparing this summer to last year’s and increases in engagement (67%) and visits to their website (62%).

- Larger organisations (those with more than 10 staff) reported a much higher increase in social media followers and engagement.

What is your reaction to these results? Please let us know at hello@insights-alliance.com, or share on social media with the hashtag #UKHeritagePulse

Pingback: IHBC’s ‘Evaluation’ signpost: UK Heritage Pulse Survey research | IHBC NewsBlogs