Executive Summary

Over three months at the start of 2026, UK Heritage Pulse is undertaking The Big Think – a sector-wide conversation shaped around three critical questions, one each month. This Big Think is centred around Place.

This three-part series aims to:

- Understand how heritage organisations currently engage with place, and their ambitions

- Map the practical relationships and challenges in place-based work

- Identify what support would strengthen heritage’s contribution to community cohesion and resilience

For the purposes of this research, ‘place’ refers to a meaningful location, and definitions vary depending on where you are and who you ask. It could mean:

- a local community,

- a natural landscape, or

- an entire city

Survey Report (The Big Think)

In January our objective was to understand how organisations currently work with place, and what “place-based heritage” means in practice, beyond the theory.

We received 170 responses to at least one question about Place, or the monthly Pulse Monitor questions, which track the individual and organisational resilience of respondents.

This is an interim report. In the subsequent Big Think surveys, panel members who did not complete this survey will have the opportunity to answer these questions.

The final section asked the monthly “Pulse Monitor” questions, which track the individual and organisational resilience of panel members.

Key findings from the research exploring Place

- 55% of respondents spend all, or almost all their time, on place-based work – increasing for smaller and voluntary organisations.

- Six-in-ten respondents care for heritage assets in a specific location

- Most organisations support one place, while larger organisations and those that do not rely on volunteers support multiple sites or networks.

- Place-based work is practical, as respondents focus on their work with the community, caring for their heritage, or engaging young people

- Long-term funding and limited staff or volunteer capacity are the biggest barriers facing the panel.

Now is the time to invest in innovation to build long-term resilience: 1.93 / 4, versus “In a crisis, we need to stick to what we know works and minimise risk”.

Pulse Monitor

Taking the pulse of the people who care for our shared heritage.

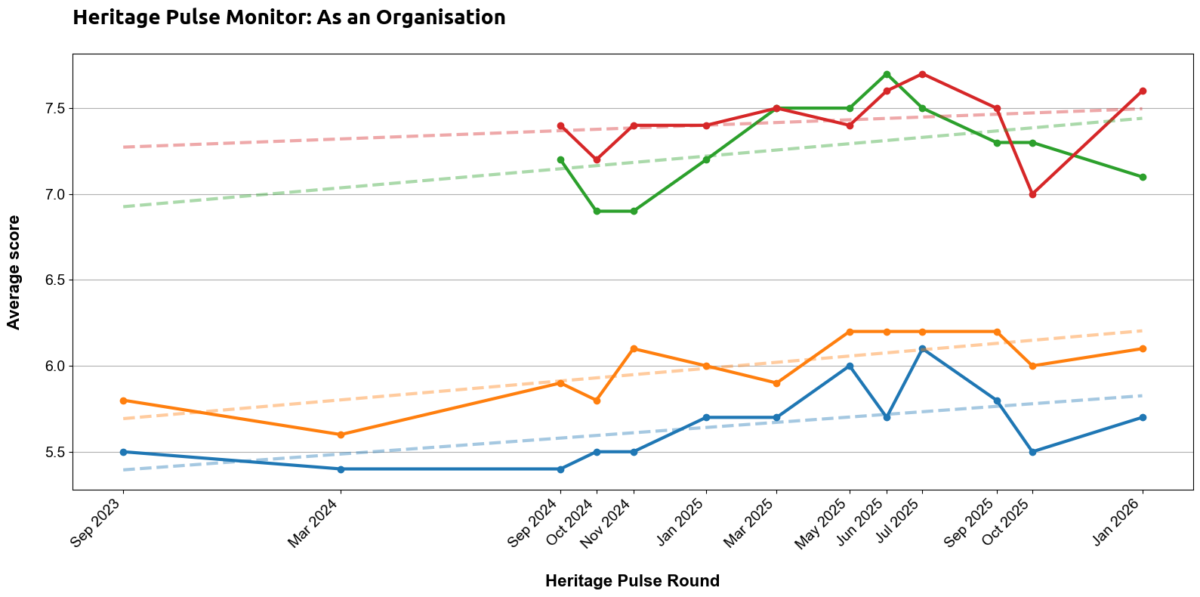

In November, we reported some exceptional results that were out-of-step with recent trends. October’s survey focussed on the respondents’ personal experience of heritage crime could have primed them to think about particularly negative aspects of their work while answering the Pulse Monitor questions.

This month we found:

- “We clearly understand our objectives and how we are performing against them” increased to 7.6 / 10 – its highest level since July 2025.

- “We are currently able to adequately care for our area of heritage / collection” partially recovered from 5.8 / 10 to 6.1 / 10 – but remains lower than at any point in 2025.

- “Most days I am uncomfortably stressed” remained unchanged at 5.1 / 10 – staying at its highest recorded level.

The Big Think: Place

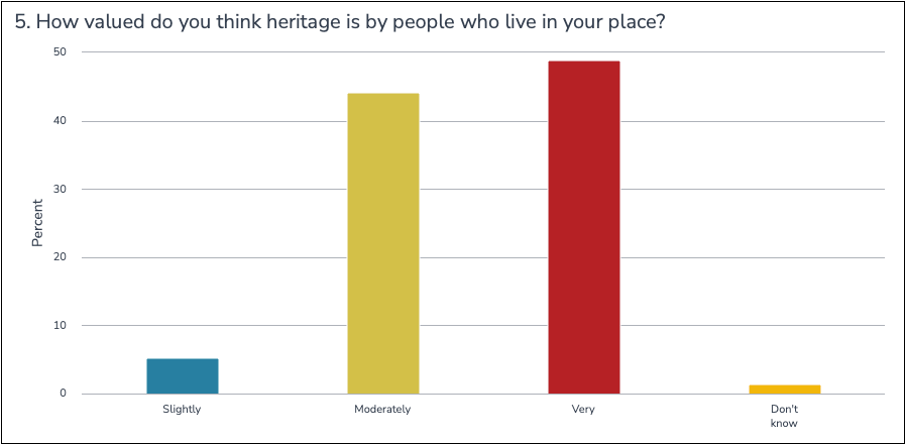

Half of panel members believe heritage is very valued by residents in their location

n=131

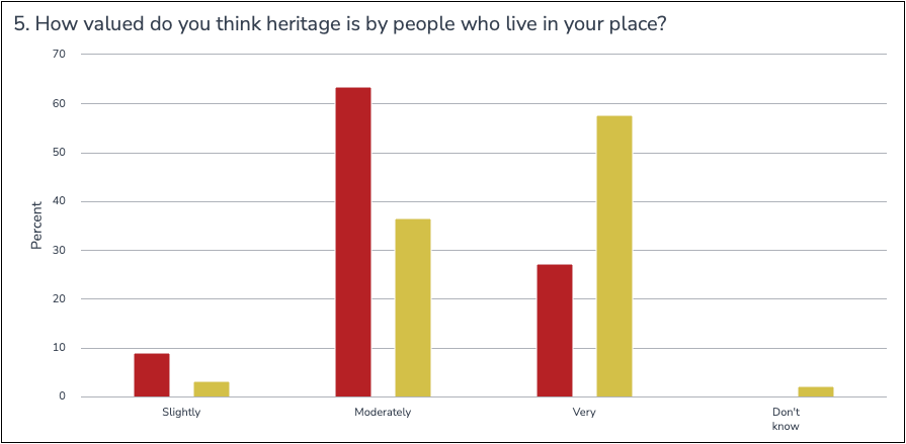

More than nine-in-ten respondents believe that heritage is moderately or very valued by those that live in their place, however voluntary organisations are less positive, with 63% believing residents moderately value heritage:

Red = Voluntary organisations / Yellow – Organisations with at least one paid employee

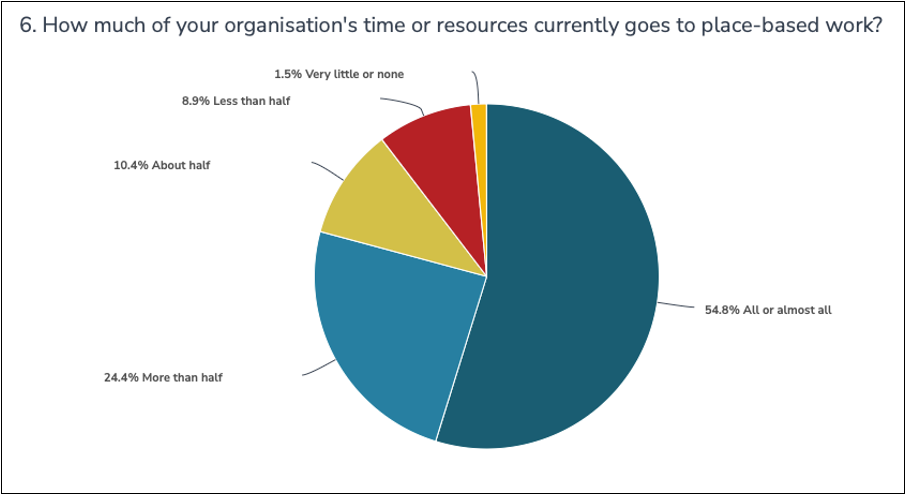

55% of respondent organisations spend all or almost of all their time on place-based work

n=135

This increases to 64% for organisations with a turnover less than £1 million and 74% for voluntary organisations.

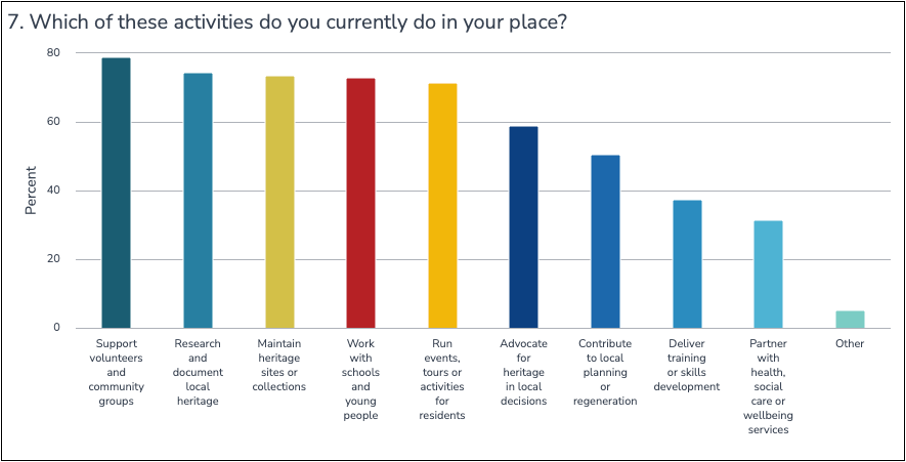

The primary activity for panel members is supporting volunteers and community groups

n=130

Heritage Pulse panel members spend their time on practical activities, working with the community, caring for heritage, or engaging young people. Activities with a more strategic focus, such as contributing to the planning process or partnering with health services, are a lower priority.

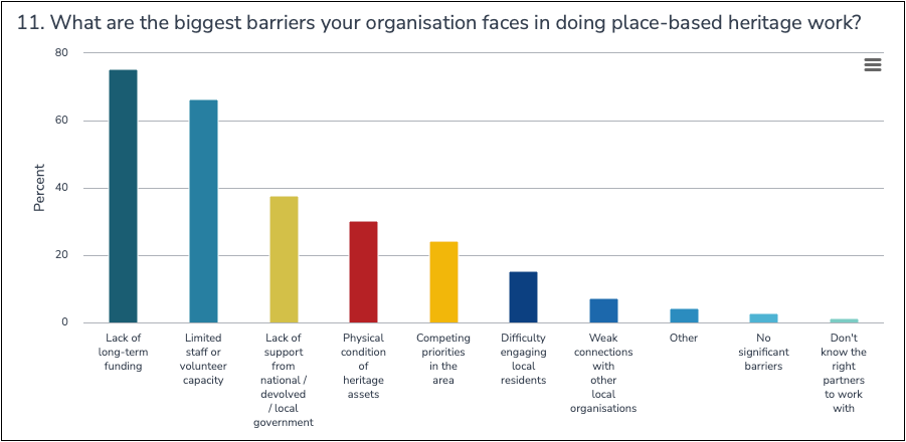

Funding and organisational capacity biggest barriers to place-based work

n=135

Even when looking at the results by organisation turnover, or between those with paid employees or voluntary organisations, lack of funding and staff / volunteer capacity remain the most frequently cited barriers.

Where respondents believed the options did not cover the barriers they faced, they were invited to contribute them:

London-centric policy [creates] viability challenges.

Repeat local visits need to be event driven, and it’s interlinked with needing staff and timetable capacity.

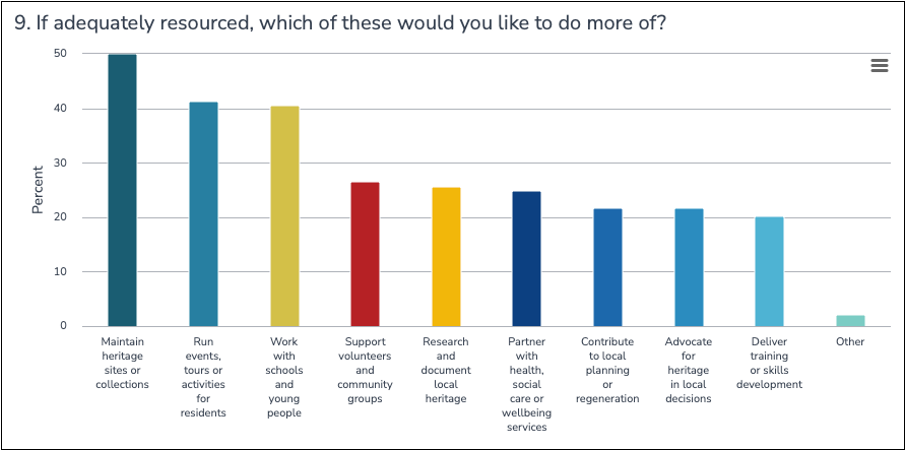

If adequate resources were available, panel would prioritise maintenance for their site or collection

n=128

When segmenting for different types of organisations, those with turnover less than £1 million would focus as much on creating more events, as maintaining their sites or collections.

60% of respondents work within one place

n=151

When segmenting for type of organisation:

- 71% of organisations with a turnover less than £1 million work within one place, while 54% of organisations with a turnover greater than £1 million work with multiple specific places.

- 94% of voluntary organisations work primarily in one place, while 44% of organisations with at least one paid employee work across multiple places.

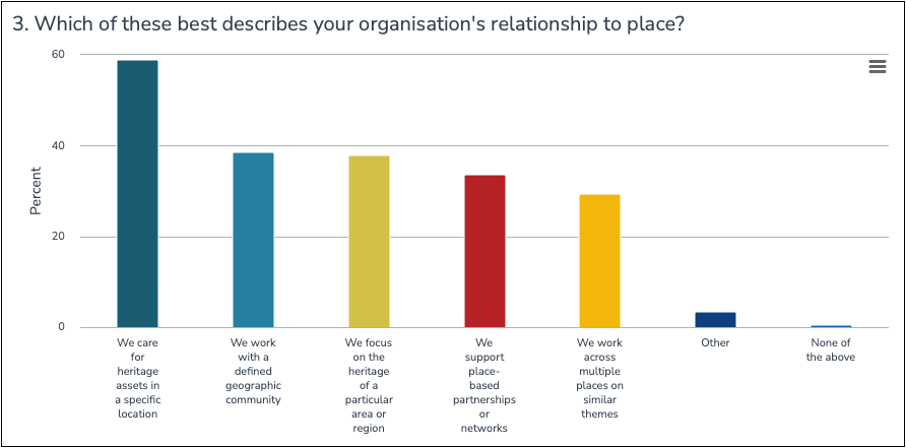

59% of respondents care for heritage assets in a specific location

n=139

Of those that are place based, most respondents care for heritage assets in a specific location. That relationship to place remains the same when segmenting by turnover and number of employees.

Pulse Monitor

Pulse Monitor is a monthly health check on the heritage sector, measuring its resilience, confidence and ambition.

In November, we reported some exceptional results that were out-of-step with recent trends. The focus on the respondents’ personal experience of heritage crime earlier in the survey could have primed them to think about particularly negative aspects of their work while answering the Pulse Monitor questions (more commonly known as question order effects). In addition, we had the fewest respondents to Pulse Monitor (n=76) all year, meaning extremes could skew the average scores.

October’s survey found that:

- “We clearly understand our objectives and how we are performing against them” fell by half a point (7.5 to 7) – its lowest recorded Pulse Monitor score.

- “We are currently able to adequately care for our area of heritage / collection” fell by more than half a point (6.5 to 5.8) – its lowest rating since March 2024.

- “Most days I am uncomfortably stressed” increased by more than half a point (4.4 to 5.1) – the highest recorded level.

We asked these questions again in January to see if these were outliers, or an indication of a new trend in the sector

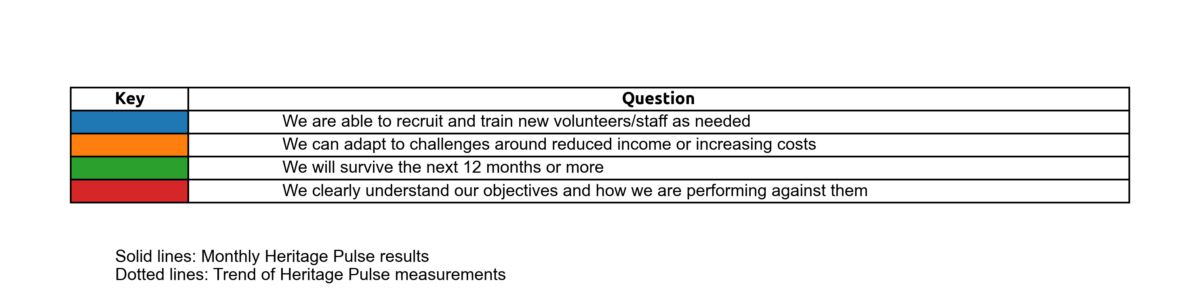

Panel’s confidence when facing organisational challenges is at six-month high

131 panel members completed this question

This month we saw increases in most organisation measures, however following its 7% fall last month, the panel’s understanding of their objectives increased to 7.6 / 10 – its highest level since July 2025.

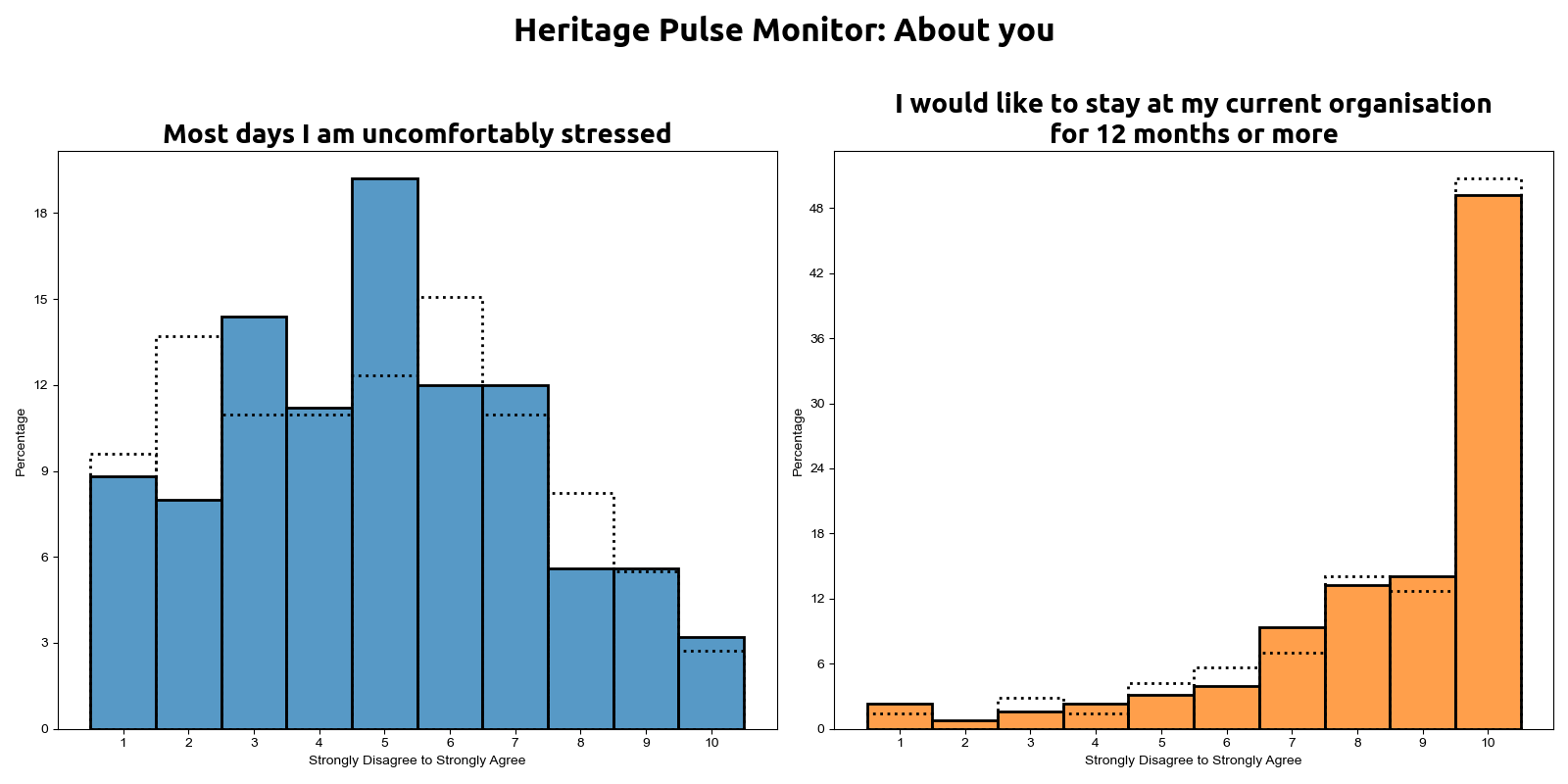

Solid bars: January 2026 response distribution / Dotted bars: October 2025 response distribution

The recovery in respondents’ understanding of their objectives has been driven by a shift away from scores of between 1-5, with increases to higher scores. The measure also has the narrowest range of responses this month.

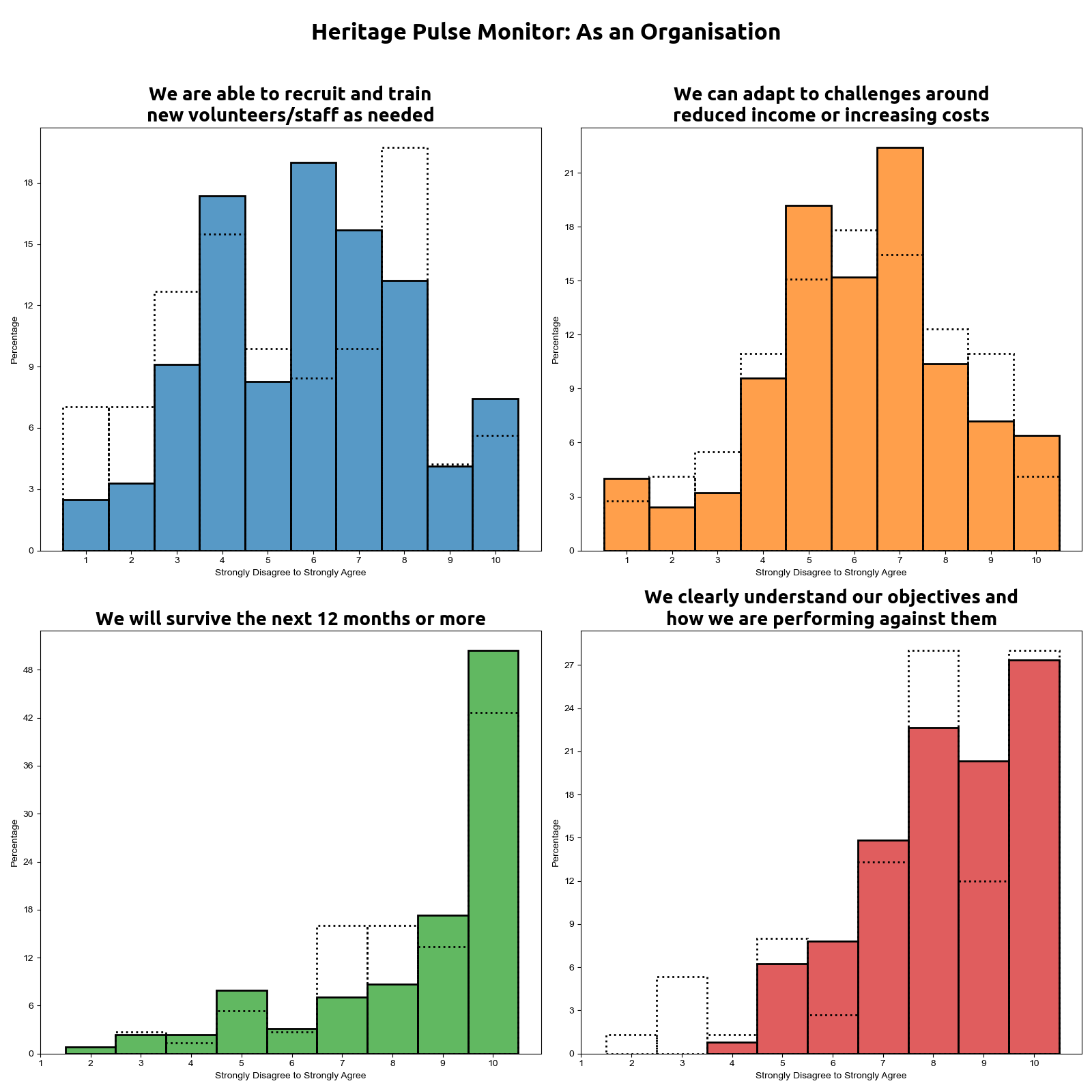

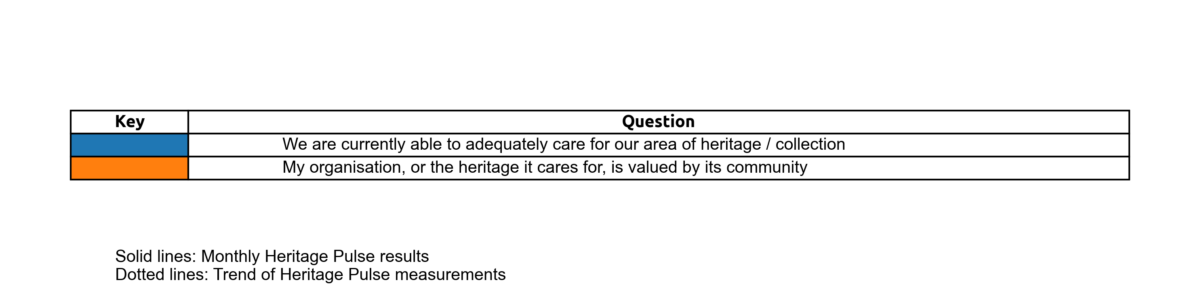

Panel’s ability to care for heritage remains below 2025 levels

131 panel members completed this question.

Following October’s 11% fall in panellists’ belief they can adequately care for their collection or area of heritage, there was a small recovery from 5.8 / 10 to 6.1 / 10. This month we also saw a slight fall in respondents’ confidence that the community values their heritage.

Solid bars: January 2026 response distribution / Dotted bars: October 2025 response distribution

Looking at the fall in confidence of the community’s value of heritage, we can see a shift away from 8-10 / 10, with 7 / 10 the most common answer this month. The narrow clustering of responses to the higher end of the scale shows that there is broad agreement that heritage is valued by their community.

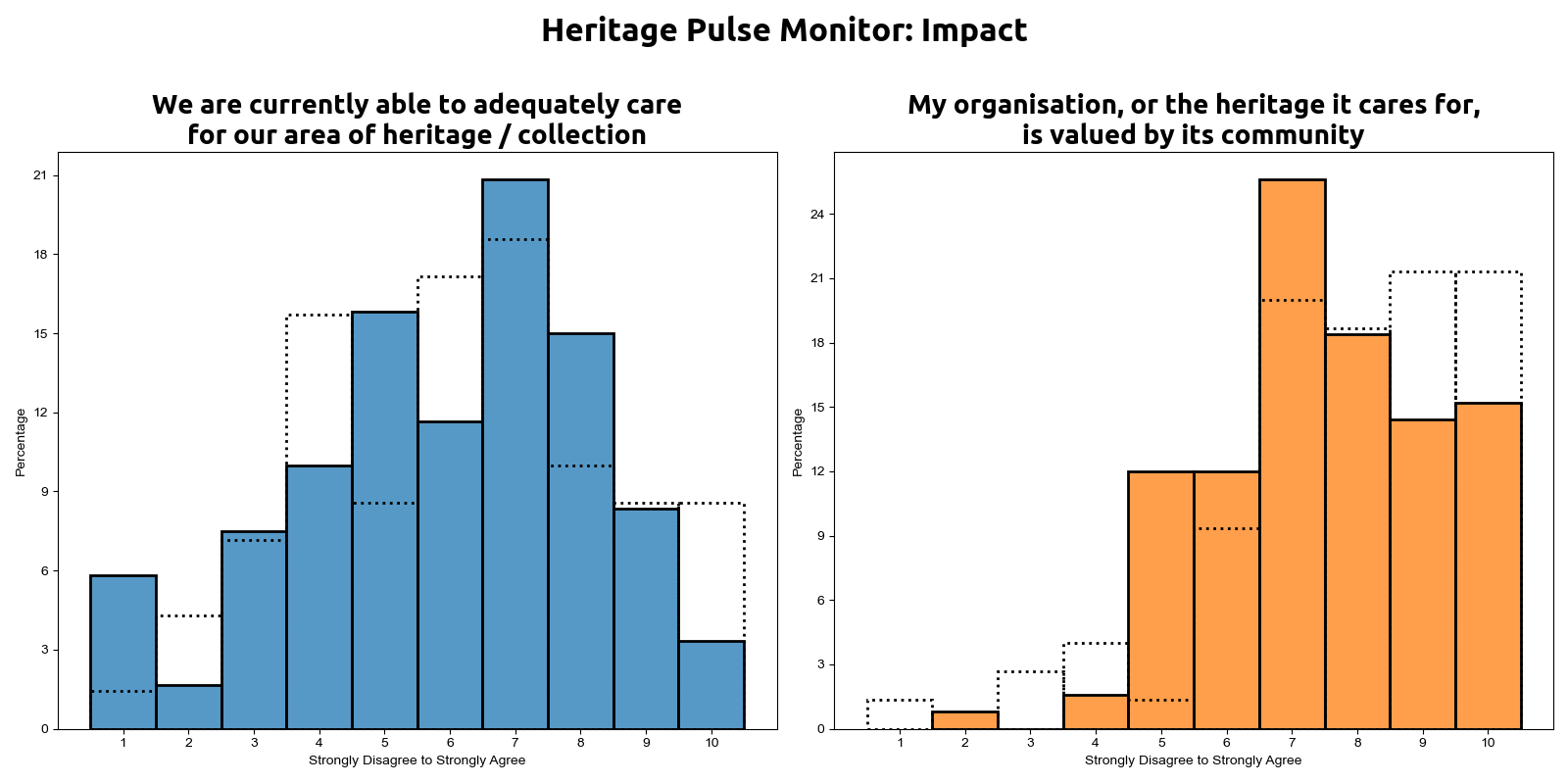

Reported stress stays at highest level

130 panel members completed this question

This month we saw the reported stress of the panel remain at 5.1 / 10 – 16% higher than its level in September 2025.

Solid bars: January 2026 response distribution / Dotted bars: October 2025 response distribution

Following a similar pattern as the measure of the community’s confidence in the value of heritage, when looking at the reported stress of participants there is a shift from 1-2 / 10, to 3-5 / 10 this month. Despite this, this question has the widest variation in responses amongst the panel.

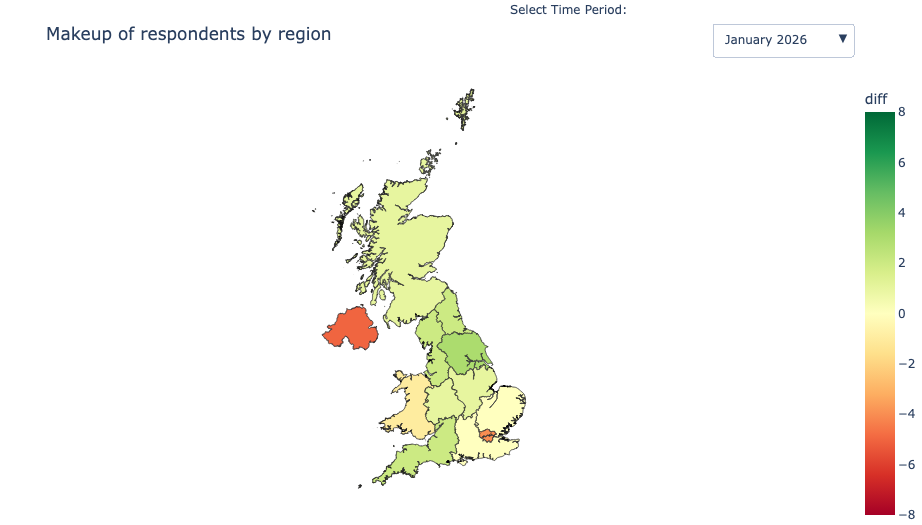

How representative of the Heritage Pulse panel were the January 2026 respondents?

Compared to the whole panel, Northern Ireland (-5 points) and London (-4 points) were the most underrepresented regions in this survey. By contrast, Yorkshire and the Humber was the most overrepresented region, three points higher than its panel average.

Photo by Simon Morley on Unsplash

ENDS